When sending international wire transfers, ensuring funds reach their destination safely and efficiently is a common concern—especially when routing money to Central Africa. One critical element in this process is the correct bank identifier code. Today, we examine the SWIFT/BIC code for the Bank of Central African States (BEAC), its structure, and its applications in global transactions.

The BEAC SWIFT Code: BEACCMCX140

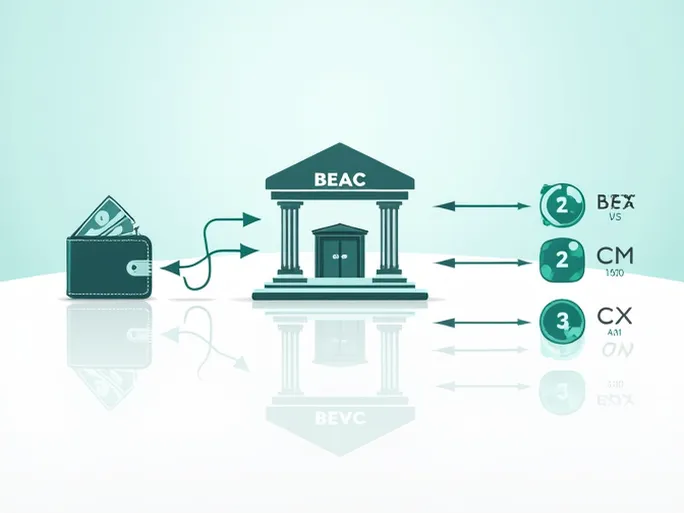

The SWIFT code BEACCMCX140 is essential for facilitating international financial transactions involving BEAC. This alphanumeric identifier ensures seamless fund routing. Below is a breakdown of its components:

- BEAC : The bank code, representing the Bank of Central African States.

- CM : The country code, indicating Cameroon as the bank’s location.

- CX : The location code, specifying the bank’s address.

- 140 : The branch code, pinpointing the exact banking division.

Complete Bank Details

For accurate transfers, pair the SWIFT code with the following details:

- Bank Name : Bank of Central African States (BEAC)

- City : Limbe

- Address : Fako Division, Limbe

- Country : Cameroon

Why Accuracy Matters

In cross-border transactions, even minor errors in the SWIFT code can lead to delays or failed transfers. Verifying the code’s validity before initiating a transaction is crucial, as updates may occur periodically. Whether sending or receiving funds, using the correct identifier— BEACCMCX140 —guarantees that money reaches the intended bank and branch without complications.

Beyond code verification, double-checking recipient details minimizes risks. Adopting these practices ensures secure and efficient international money transfers to Central Africa.