In today's globalized financial environment, ensuring smooth fund transfers is paramount. International remittances often present challenges, particularly when accurate banking details are required. This article explains how to properly use the SWIFT/BIC code for KRUNG THAI BANK PUBLIC COMPANY LIMITED to prevent transaction delays.

When sending funds to Thailand's KRUNG THAI BANK, the essential SWIFT/BIC code to remember is KRTHTHBK PMP . This alphanumeric combination serves as a unique identifier for the financial institution, enabling global banking systems to quickly recognize the specific bank and its branch locations. Headquartered in Bangkok, KRUNG THAI BANK's established reputation makes it a reliable choice for international transfers.

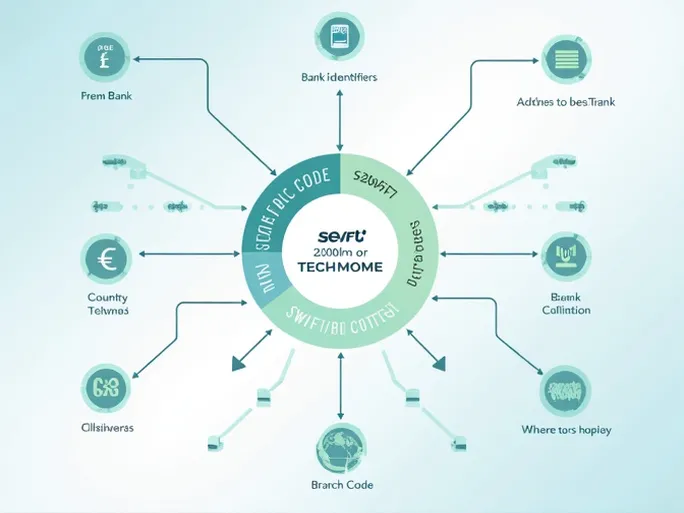

To guarantee a smooth transaction process, always verify the SWIFT/BIC code before submitting your transfer request. These codes typically contain 8 to 11 characters following a standardized format: the first four letters represent the bank code, followed by two-letter country code, two-character location identifier, and an optional three-digit branch code.

Using the correct SWIFT/BIC code ensures funds reach the intended recipient without complications. For instance, a $10,000 transfer to KRUNG THAI BANK using code KRTHTHBK PMP would convert to approximately €8,485 for the beneficiary. Such currency conversion is critical in international transactions, as exchange rate fluctuations can significantly impact the final amount received.

Financial experts recommend double-checking all transfer details, including the SWIFT code, before initiating transactions. This precaution minimizes potential errors that could delay payments or result in financial losses. Should any questions arise during the process, contacting your bank's customer service department can provide immediate clarification and support.

SWIFT/BIC codes remain fundamental to international money transfers. Proper understanding and application of these identifiers adds security to cross-border transactions. Whether you're new to international banking or an experienced sender, mastering these details ensures confidence when navigating global financial systems.