In today's rapidly evolving global financial landscape, international money transfers between individuals and businesses have become routine transactions. As trade, investment, and overseas migration continue to grow, electronic transfers increasingly serve as the backbone of cross-border financial operations.

While digitalization and automation have significantly reduced transfer times, the accuracy of SWIFT/BIC codes remains paramount for ensuring secure and precise fund delivery. The SWIFT (Society for Worldwide Interbank Financial Telecommunication) network and BIC (Bank Identifier Code) system play pivotal roles in this process.

Understanding SWIFT/BIC Codes

Take Bangkok Bank as an example. With its extensive international network and long-standing history, the Thai institution operates with the SWIFT code BKKBTHBKXXX . This alphanumeric sequence serves as both the bank's global identifier and a crucial requirement for successful international transfers.

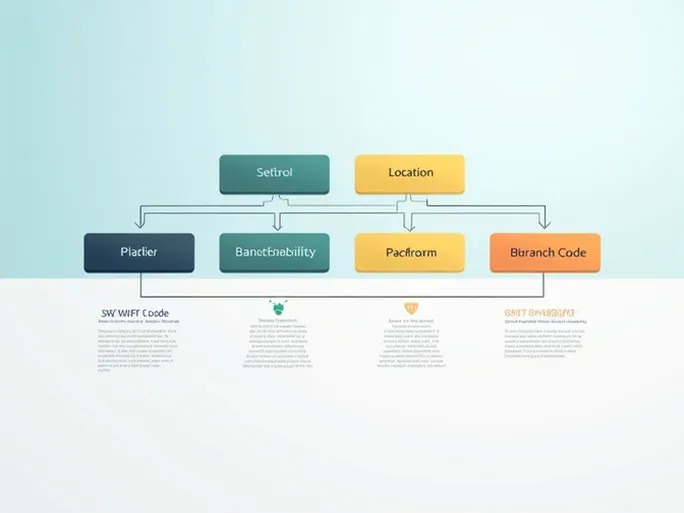

Located at 333 Silom Road, Bangruk, Bangkok, the bank's headquarters functions as the central hub for its financial operations. A typical SWIFT/BIC code contains 8-11 characters divided into distinct sections:

- First 4 letters: Bank code (BKKB for Bangkok Bank)

- Next 2 letters: Country code (TH for Thailand)

- Following 2 letters: Location code (BK for Bangkok)

- Optional final 3 characters: Branch identifier

The Consequences of Incorrect Codes

International transfers require complete beneficiary information, including account details and the correct SWIFT code. Errors in this information may result in misdirected funds or processing delays. Financial institutions occasionally update their codes due to restructuring or branch modifications, making periodic verification essential.

Beyond code accuracy, factors such as transfer amounts, currency selection, and reference details significantly impact transaction efficiency. Various jurisdictions impose distinct regulations on international transfers, including limits on transaction values and frequencies.

Cost Considerations and Emerging Alternatives

Transfer costs typically include intermediary bank fees and potential exchange rate losses. Comparative analysis of different financial institutions' fee structures enables users to identify the most cost-effective solutions.

The financial technology revolution has introduced new international transfer platforms offering competitive rates and faster processing times compared to traditional banking services. However, these services often still rely on conventional banking infrastructure, making correct SWIFT/BIC codes indispensable.

Global Remittance Trends

International Monetary Fund data reveals annual cross-border remittances reaching trillions of dollars, with personal transfers constituting a substantial portion. This growth reflects increasing global mobility for employment, education, and family support purposes.

As financial technology advances, international transfer services will likely become more efficient and intelligent. Nevertheless, the fundamental importance of accurate SWIFT/BIC codes remains unchanged, serving as the cornerstone of secure global financial transactions.