In today's globalized economy, international financial transactions have become remarkably convenient, enabling seamless cross-border payments, investments, and other monetary activities. Yet the technical infrastructure facilitating these transactions often goes unnoticed—particularly the use of SWIFT codes. This article examines the critical role of SWIFT codes, with specific focus on Starling Bank Limited's identifier SLRGGB3LXXX, to provide comprehensive understanding of this vital financial instrument.

I. Understanding SWIFT Codes

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code serves as a unique identifier for financial institutions worldwide. Developed to ensure speed and accuracy in international transactions, these 8-11 character alphanumeric sequences contain specific institutional and geographic information.

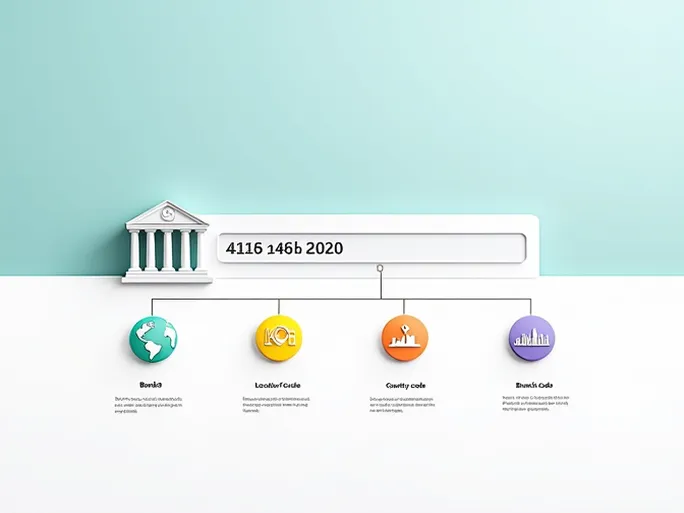

1. SWIFT Code Structure

The standardized format consists of:

- First 4 characters: Bank code (e.g., "SLRG" for Starling Bank)

- Next 2 characters: Country code ("GB" for United Kingdom)

- Following 2 characters: Location code ("3L" designating specific branch)

- Final 3 characters (optional): Branch identifier ("XXX" indicates primary office)

2. Operational Significance

SWIFT codes form the backbone of secure international fund transfers. Financial institutions rely on these identifiers to accurately route payments, with correct usage minimizing processing errors and delays. When senders input the proper SWIFT code, funds reach intended recipients with optimal efficiency.

II. Decoding Starling Bank's SWIFT: SLRGGB3LXXX

For individuals conducting international transfers involving Starling Bank, understanding each component of SLRGGB3LXXX proves essential.

1. Bank Identification (SLRG)

The initial four letters represent the institution's abbreviated name, confirming the recipient as Starling Bank.

2. Country Specification (GB)

The subsequent two-character country code verifies the bank's United Kingdom jurisdiction, ensuring proper geographic routing.

3. Location Details (3L)

This segment pinpoints the specific branch location, though Starling's digital-first model typically uses this as a general identifier rather than denoting physical premises.

4. Branch Designation (XXX)

The terminal "XXX" confirms this as the bank's primary identifier rather than a branch-specific code, suitable for most customer transactions.

III. Practical Applications

SWIFT codes facilitate numerous international financial operations:

1. Personal Remittances

Individuals transferring funds internationally—such as sending money from U.S. accounts to U.K. recipients—must provide the correct SWIFT code (SLRGGB3LXXX for Starling Bank) through their banking platform to ensure successful processing.

2. Corporate Transactions

Businesses conducting cross-border trade rely on accurate SWIFT codes for supplier payments and receivables. Errors can result in misdirected funds or processing delays impacting commercial operations.

3. Investment Activities

Global investors utilize SWIFT codes to swiftly move capital between international accounts, enabling timely participation in financial opportunities while maintaining liquidity.

IV. Verification Protocols

To prevent transfer complications, users should:

1. Confirm Institutional Details

Cross-reference SWIFT codes with official bank sources before initiating transfers. Starling Bank provides current identifiers through its official channels.

2. Validate Geographic Specifics

Ensure the country and location codes align with the intended transaction path, particularly when dealing with institutions having multiple international branches.

3. Verify Recipient Information

Double-check account details alongside SWIFT codes to prevent misdirected payments, as errors may require lengthy resolution processes.

Conclusion

In our interconnected financial ecosystem, proper SWIFT code usage remains fundamental for secure, efficient international transactions. Starling Bank's SLRGGB3LXXX exemplifies how these identifiers combine institutional and geographic data to facilitate global money movement. By understanding and accurately applying such codes, individuals and businesses can optimize their cross-border financial operations while minimizing processing risks.