In today's globalized economy, international money transfers have become increasingly common. Whether for individual cross-border purchases or business transactions with overseas suppliers, sending money across borders is now an essential part of financial activities. However, ensuring a smooth transfer process requires attention to detail—particularly when it comes to using the correct SWIFT code.

Understanding SWIFT Codes

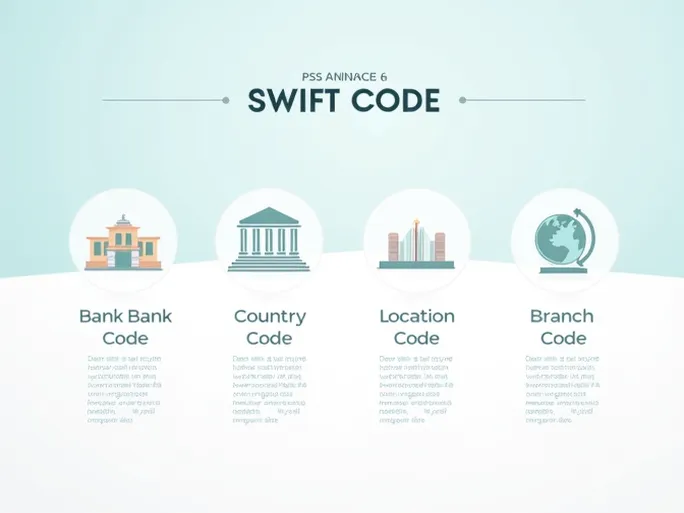

SWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunication , is a secure messaging network that enables financial institutions worldwide to communicate and process transactions. Each bank participating in the SWIFT network is assigned a unique identifier known as a SWIFT code (also referred to as a BIC code). This code typically consists of 8 to 11 characters, structured to identify the bank, country, location, and branch.

Decoding HSBC UK BANK PLC's SWIFT Code

For HSBC UK BANK PLC, the SWIFT/BIC code is HBUKGB4B72A . Breaking this down:

- HB – The bank code, uniquely identifying HSBC.

- UK – The country code, indicating the bank is based in the United Kingdom.

- GB – The location code, specifying the region within the UK.

- 4B – The branch code, pinpointing the exact office or department.

- 72A – An optional extension, further refining the destination branch.

Understanding these components ensures that the SWIFT code is not merely a random string but a precise identifier for routing funds correctly.

Why Accuracy Matters

Using an incorrect SWIFT code can lead to significant complications, including delayed transfers, additional fees, or even misdirected funds. In some cases, recovering lost payments may require extensive time and effort. To avoid such issues, always verify the SWIFT code through official channels such as the bank's website or customer service.

The Role of SWIFT in Global Finance

Beyond facilitating transfers, SWIFT codes play a critical role in the broader financial ecosystem. The SWIFT network acts as a secure conduit for banks to exchange vital information, including payment confirmations, account details, and transaction instructions. Think of it as the nervous system connecting global financial institutions, with SWIFT codes serving as the digital addresses that ensure seamless communication.

Preparing for a Successful Transfer

In addition to the SWIFT code, international transfers require other key details:

- The recipient's full account information.

- The recipient bank's physical address (for HSBC UK BANK PLC, this is often Silver Street Head, Mortgage Service Centre, Sheffield, South Yorkshire, S1 2QA, United Kingdom ).

- Any additional regulatory or intermediary bank requirements.

Double-checking these details minimizes the risk of errors and ensures faster processing.

Potential Challenges and Solutions

Even with the correct SWIFT code, international transfers may encounter delays due to intermediary bank processing or regulatory reviews. In such cases, maintaining open communication with your bank and the recipient is crucial. Most financial institutions offer dedicated support to resolve transfer-related issues efficiently.

Best Practices for International Transfers

To streamline the process, consider the following tips:

- Verify the SWIFT code through official sources before initiating a transfer.

- Maintain clear communication with both the sending and receiving parties to confirm transaction details.

- Ensure precise account information to prevent misrouting of funds.

- Review exchange rates and fees to understand the total cost of the transfer.

Mastering the use of SWIFT codes is more than a technical necessity—it reflects the efficiency and precision required in global financial transactions. Whether for personal or business purposes, accurate information ensures that your funds reach their destination securely and without unnecessary delays.