In an era of rapid global economic transformation, international money transfers have become an essential part of daily life for individuals and businesses alike. With the rise of cross-border transactions and global capital flows, ensuring accurate and secure remittances is more critical than ever. However, for many senders, selecting and using the correct SWIFT/BIC code remains a challenge—especially when sending funds to Zimbabwe. In this context, understanding the SWIFT code for the Reserve Bank of Zimbabwe is particularly important.

The Importance of Correct SWIFT/BIC Codes

Have you ever felt confused during an international transfer, particularly when searching for the right SWIFT/BIC code? A growing number of people are realizing that using the correct SWIFT code is not just about security—it also affects the accuracy and speed of the transaction. An incorrect code can result in funds failing to reach the intended account or unnecessary delays. To help streamline the process, this article examines the SWIFT code for the Reserve Bank of Zimbabwe and its significance.

Decoding the SWIFT/BIC: REBBZWHBXXX

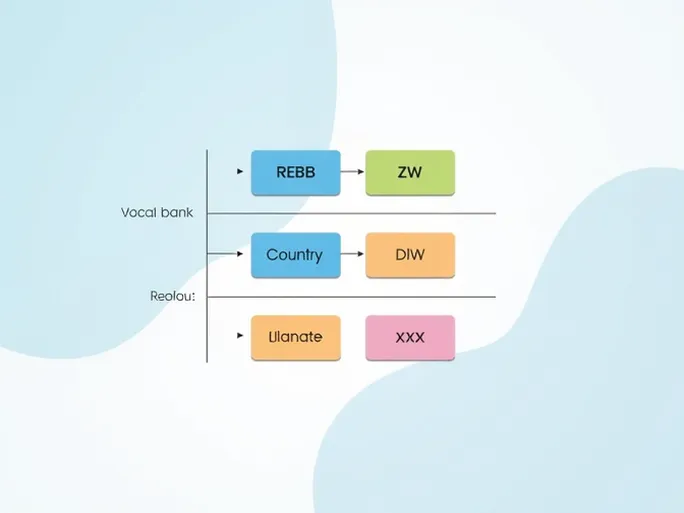

The SWIFT/BIC code for the Reserve Bank of Zimbabwe is REBBZWHBXXX . While it may appear simple, each segment of this code carries specific meaning, ensuring funds are routed correctly.

The first four letters, REBZ , identify the Reserve Bank of Zimbabwe. As the country’s central bank, it plays a pivotal role in monetary policy, financial stability, and regulatory oversight. This segment ensures the transfer reaches the correct institution.

The following two letters, ZW , represent Zimbabwe’s country code under international standards. This universal identifier clarifies the destination country. The next two letters, HB , denote the bank’s location, facilitating smooth processing within Zimbabwe’s financial system. The final XXX indicates the transaction is directed to the bank’s head office.

Why Accuracy Matters

At its core, a SWIFT code enables precise routing of funds across the global banking network. Using REBBZWHBXXX ensures transfers are processed securely and efficiently. Errors in the code can lead to delays or failed transactions, making verification a sender’s responsibility.

Beyond individual transactions, the correct use of SWIFT/BIC codes reflects broader financial transparency and integration. The Reserve Bank of Zimbabwe’s role in managing monetary policy and economic stability means international transfers contribute to the country’s financial framework.

Best Practices for International Transfers

When initiating a transfer, double-check all details, including the recipient’s name and account number, to avoid discrepancies. Many financial institutions offer SWIFT code lookup tools for added verification. Additionally, selecting reputable service providers minimizes risks associated with fraud or inefficiencies.

In today’s interconnected economy, understanding SWIFT/BIC codes is more than a transactional necessity—it’s a step toward seamless global financial participation. Whether sending funds to family or conducting business, attention to these details ensures a smooth and secure process.