In today's globalized economy, international money transfers have become increasingly vital for both commercial transactions and personal remittances. Whether paying foreign suppliers or sending funds to family members working abroad, international wire transfers represent a crucial financial activity. At the heart of this process lies the SWIFT code—an indispensable component of cross-border payments. This article explores the meaning, structure, usage, and significance of SWIFT codes, with particular reference to NATIONAL BANK LIMITED, to provide comprehensive understanding of international money transfers and their security implications.

Understanding SWIFT Codes

The SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is a standardized system of identification for financial institutions worldwide, established by the international banking cooperative. Similar to how countries have unique country codes (such as CN for China or US for the United States), each bank maintains its distinctive SWIFT code. These codes ensure funds follow correct routing paths during international transfers, reaching their intended destinations accurately.

Typically comprising 8 to 11 characters, SWIFT codes contain bank, country, location, and optional branch identifiers. This system enables banks to exchange financial messages securely and efficiently, preventing transactional errors caused by miscommunication. It serves as a precise and secure solution for global financial transactions.

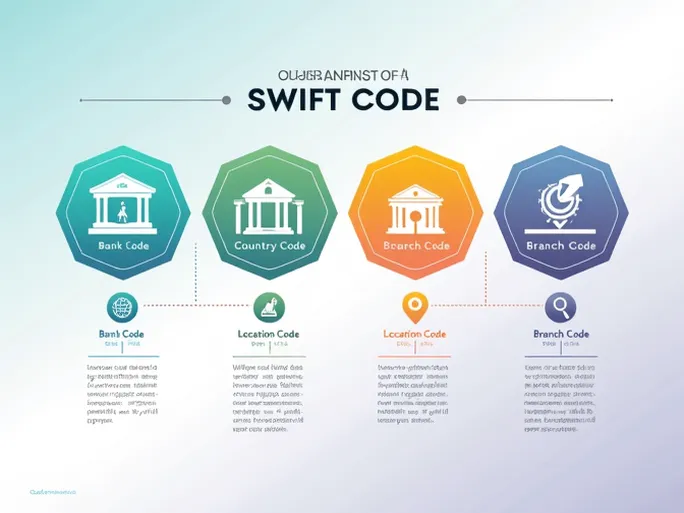

Structure of SWIFT Codes

Understanding SWIFT code composition proves essential for international money transfers. A complete SWIFT code consists of four distinct components:

- Bank Code (4 letters): The initial four letters identify the specific financial institution. For NATIONAL BANK LIMITED, this appears as NBLB, representing the bank's unique identifier.

- Country Code (2 letters): Following the bank code, two letters denote the institution's home country. NATIONAL BANK LIMITED uses BD, indicating Bangladesh, which facilitates regional transaction processing.

- Location Code (2 characters): These characters specify the bank's headquarters location, often revealing city or geographical information. In NATIONAL BANK LIMITED's case, DH identifies a particular location in Bangladesh.

- Branch Code (optional, 3 characters): The final three characters designate specific branches, particularly important for large banking institutions. The digits 008 in our example identify a particular branch or service center.

This four-part combination creates unique identifiers that enable clear recognition of fund routing paths and destinations, ensuring transaction efficiency and security.

Case Study: NATIONAL BANK LIMITED's SWIFT Code

Examining NATIONAL BANK LIMITED's SWIFT code (NBLBBDDH008) provides practical understanding:

- Bank Name: NATIONAL BANK LIMITED

- City: Sylhet

- Address: Laldighir Par, Sylhet, Sylhet, 3100

- Country: Bangladesh

This information clearly identifies the bank and its geographical location, providing essential context for international transactions. Verifying such details before initiating transfers prevents potential errors and delays.

Proper Usage and Critical Importance

Correct SWIFT code usage remains paramount for international transfers, as each code uniquely identifies financial institutions. Input errors may redirect funds to incorrect banks or accounts, potentially causing financial loss.

For instance, entering a similar but incorrect SWIFT code for NATIONAL BANK LIMITED could divert funds to another institution entirely. Resolving such mistakes requires significant time and effort, potentially incurring additional fees and processing delays.

Verification Methods: Before initiating international transfers, always confirm recipient SWIFT codes through:

- Official bank websites (most institutions publish SWIFT code information)

- Direct communication with bank customer service representatives

- Reputable financial service platforms offering SWIFT code lookup services

Fund Security Considerations

International transfers involve substantial cross-border fund movements, making security particularly crucial. Proper SWIFT code usage protects fund flows against potential risks and losses. Compared to domestic payments, international transactions face additional complexities including exchange rate fluctuations, varying national regulations, and tax implications. Errors may disrupt business relationships with suppliers or clients and affect future transactions.

The SWIFT network itself maintains robust security measures, featuring advanced encryption protocols to safeguard sensitive financial data. When selecting service providers, choosing reputable, properly licensed institutions further enhances transaction security.

Conclusion

For individuals and businesses conducting international transfers, understanding SWIFT codes proves essential. Correct code usage ensures secure, accurate fund delivery, as demonstrated by NATIONAL BANK LIMITED's SWIFT code (NBLBBDDH008). As global economic connectivity and trade continue expanding, SWIFT codes form the foundational infrastructure enabling cross-border financial flows. All international transfer participants should meticulously verify necessary information to ensure smooth, secure financial transactions.