In today's globalized financial landscape, international money transfers can often present challenges. When dealing with complex cross-border transactions, ensuring secure and accurate fund transfers becomes paramount. In this process, SWIFT codes serve as indispensable "escorts" for international money movements. If you're planning to send money to Chile, understanding BANCO DE CHILE's SWIFT code will provide both security and efficiency for your transaction.

Comprehensive Breakdown of BANCO DE CHILE's SWIFT Code

Let's begin by unveiling BANCO DE CHILE's SWIFT code: BCHICLRMXXX . This alphanumeric sequence isn't merely a random string—it serves as a critical bridge in the global financial network, ensuring funds flow accurately through the invisible web of international banking.

1. Understanding SWIFT Codes

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) was established in 1973 to standardize and enhance the efficiency and security of international financial communications. Also known as Bank Identifier Codes (BIC), SWIFT codes primarily identify banks and financial institutions worldwide. Through the SWIFT network, thousands of financial institutions can securely send and receive information about monetary transfers.

2. Key Information About BANCO DE CHILE

Bank Name:

BANCO DE CHILE

City:

Santiago

Address:

Paseo Ahumada 251, Santiago, Provincia de Santiago, 8320206

Country:

Chile

Within Chile's financial sector, BANCO DE CHILE plays a pivotal role as one of the country's oldest and most globally influential banks. Recognized for its stable financial management and comprehensive range of products and services, the bank offers professional support for both personal banking needs and corporate financial solutions.

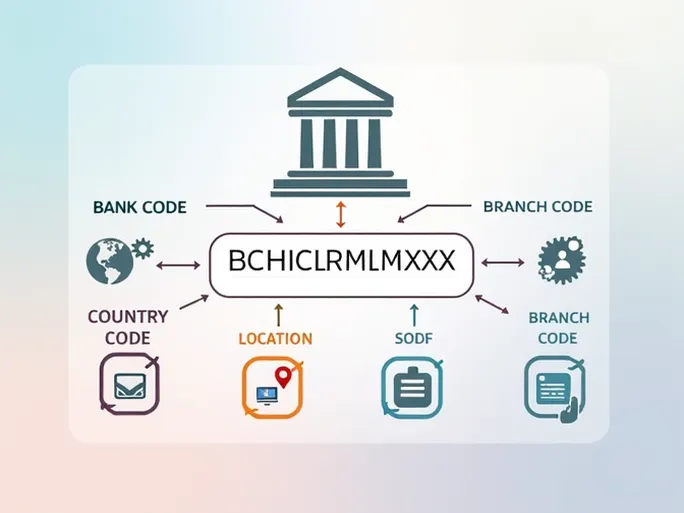

3. Structure and Function of BCHICLRMXXX

SWIFT/BIC codes consist of 8 to 11 alphanumeric characters, with variations depending on the financial institution. Let's examine the components of BCHICLRMXXX:

- BCHI - Bank code identifying BANCO DE CHILE

- CL - Country code for Chile

- RM - Location code indicating the bank's headquarters

- XXX - Branch code signifying the head office

4. When to Use BCHICLRMXXX

Understanding the composition of BCHICLRMXXX will increase your confidence when initiating cross-border transfers to BANCO DE CHILE. Whether you're paying for goods and services or sending money to family and friends, providing the correct SWIFT code is essential.

The security and accuracy of financial transactions often hinge on the information provided during the transfer process. Always verify you're using the most current and accurate SWIFT code to prevent delays or financial losses.

5. Important Considerations When Using SWIFT Codes

Several critical factors can significantly impact the security and efficiency of international transfers:

- Verify the bank name: Always confirm the recipient bank's name matches exactly with your transfer details.

- Check branch information: If you have a specific branch SWIFT code, ensure it corresponds with the recipient's requirements.

- Confirm country details: An incorrect country code could redirect your funds to the wrong destination.

- Consult banking professionals: When in doubt, seek guidance from financial experts to clarify any uncertainties.

6. Efficiency and Risks in Cross-Border Transfers

In our rapidly evolving digital financial environment, international transfers have become commonplace for both business operations and personal needs. While financial networks offer remarkable convenience, they also present certain challenges and risks. Proper understanding and application of SWIFT codes can serve as an important safeguard for your financial transactions.

7. Trust and Transparency in International Transactions

In global commerce, trust represents one of the most valuable assets. The SWIFT network enables financial institutions worldwide to exchange information efficiently, ensuring accurate fund transfers. This impact extends beyond mere financial transactions, fostering commercial trust and strengthening international relationships.

By obtaining and properly using BANCO DE CHILE's correct SWIFT code, you establish a solid foundation for successful cross-border transactions. As global financial networks continue to evolve, mastering these fundamental skills will prove increasingly valuable in international economic activities.

8. Conclusion

In our interconnected financial world, every detail of international money transfers affects the security and success of your transactions. When navigating the complexities of global banking operations, precise information becomes the cornerstone of effective cross-border transfers. By understanding and applying BANCO DE CHILE's SWIFT code (BCHICLRMXXX), you'll approach future international transfers with confidence and competence.

Whether conducting business transactions or personal remittances, remembering these essential SWIFT code principles will help your international financial activities proceed smoothly and securely. With this knowledge, you're well-prepared to take the first step in your global financial journey.