In today's increasingly interconnected global economy, the efficiency and security of financial transactions—particularly international fund transfers—have become paramount. A robust international financial system not only supports cross-border trade but also facilitates the free movement of personal capital. Within this framework, SWIFT/BIC codes have emerged as essential tools for ensuring accurate fund transfers. Understanding these codes and their proper application is crucial for seamless international transactions.

Understanding SWIFT Codes

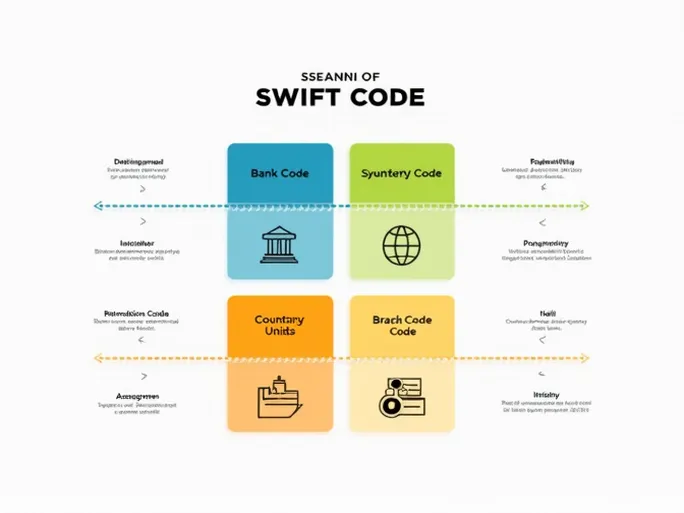

SWIFT codes, officially known as Bank Identifier Codes (BIC), are issued by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). These codes uniquely identify financial institutions worldwide, consisting of 8 to 11 characters that combine bank, country, location, and branch identifiers. This standardized system significantly reduces errors in international transfers by precisely routing funds to their intended destinations.

Decoding BOFMCAT2FXM: Bank of Montreal's SWIFT Identifier

The SWIFT code BOFMCAT2FXM, belonging to Canada's Bank of Montreal (BMO), demonstrates this structured approach:

- BOFM represents the bank's unique identifier within the SWIFT network

- CA denotes Canada as the destination country, preventing confusion with similarly named locations

- T2 specifies the particular banking location within Canada

- FXM identifies the exact branch, ensuring funds reach the specific account

This precise coding structure exemplifies the financial industry's commitment to transactional accuracy in an era of global capital flows.

The Imperative of Accurate SWIFT Code Usage

Incorrect SWIFT codes can lead to delayed or lost transfers, potentially causing significant financial losses. Whether for personal remittances or corporate transactions, verifying the accuracy of these codes remains the most critical step in international banking.

Strategies for Optimizing International Transfers

Beyond understanding SWIFT codes, several practices can enhance cross-border payment efficiency:

- Verification: Double-check all transfer details, especially SWIFT codes and account numbers

- Fee transparency: Understand all applicable charges before initiating transfers

- Regulatory awareness: Stay informed about destination countries' banking policies and restrictions

- Bank communication: Regularly consult with financial institutions about potential SWIFT code updates

Bank of Montreal in the Global Financial Landscape

As one of Canada's premier financial institutions and an active participant in international markets, Bank of Montreal facilitates seamless global transactions through its extensive network. The proper use of its SWIFT code BOFMCAT2FXM exemplifies how standardized financial tools enable secure, efficient cross-border banking.

For individuals, mastering these financial fundamentals builds confidence in managing international transactions. For businesses, such knowledge becomes a competitive advantage in global market expansion and financial operations.

Conclusion

SWIFT/BIC codes like BOFMCAT2FXM represent more than banking technicalities—they are the linchpins of secure international finance. In our globalized economy, proficiency with these financial instruments enables individuals and corporations alike to navigate cross-border transactions with precision, optimizing financial management and supporting international commerce ambitions.