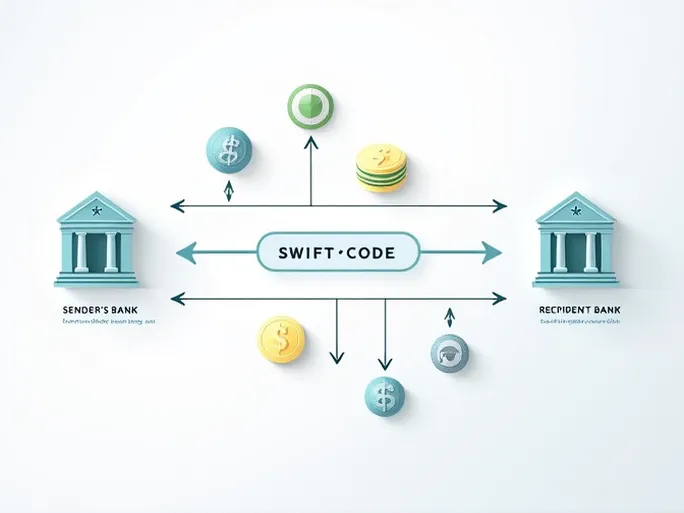

In today's globalized world, international money transfers have become a routine activity for countless individuals and businesses. Whether funding overseas education, purchasing property abroad, or providing financial support to family members in another country, selecting an efficient and secure bank for cross-border transactions is essential. Behind these transactions, SWIFT codes serve as the vital link between banks and customers, ensuring seamless and secure fund transfers.

The Backbone of International Transfers

Consider a scenario where you need to send urgent financial assistance to a loved one overseas. Choosing a reputable institution like National Commercial Bank , renowned for its exceptional service and expertise, ensures peace of mind. Its SWIFT code, LNCBLYLT083 , acts as a precise identifier, guiding your transfer to its destination. Headquartered in Tobruk, Libya, the bank has built a strong reputation for reliability and professionalism in international finance.

How SWIFT Codes Work

A SWIFT code typically consists of 8 to 11 characters, each segment representing specific details about the bank, country, location, and branch. For example, in LNCBLYLT083 , "LNCB" identifies National Commercial Bank, while "LY" stands for Libya. This structured system enhances accuracy and security, minimizing delays caused by incorrect information. By streamlining communication between financial institutions, SWIFT codes enable faster processing and instill confidence in customers.

When using National Commercial Bank for international transfers, funds typically arrive within three business days—a testament to its efficiency. In an era where timely transactions are critical, whether for business or personal needs, such speed is invaluable.

The Importance of Accuracy

One crucial reminder for customers: always double-check the SWIFT code before initiating a transfer. A minor error, such as a misplaced character, can divert funds to the wrong account, disrupt transactions, or incur unnecessary fees. These complications not only result in financial losses but also create stress during urgent situations. Verifying the SWIFT code is a simple yet vital step to ensure smooth transactions.

Comprehensive Services for Diverse Needs

National Commercial Bank offers a range of services tailored to both individual and corporate clients. Its expert team provides customized solutions for complex international transfers, addressing unique requirements with precision. Additionally, the bank continues to enhance its digital platforms, allowing customers to manage finances conveniently from anywhere.

As technology evolves, traditional banking is transforming—but security remains paramount. National Commercial Bank prioritizes safeguarding client funds, employing advanced measures to mitigate risks. Whether at home, in the office, or traveling, customers can execute transfers seamlessly with just a few clicks, knowing their money will reach its destination securely.

Exceptional Customer Support

Beyond speed and security, the quality of customer service is a defining factor in choosing a bank. National Commercial Bank takes pride in its responsive and knowledgeable support team, ready to assist with queries about SWIFT codes, cross-border procedures, or other concerns. This commitment to clear communication fosters trust and enhances the overall client experience.

For those evaluating international transfer options, National Commercial Bank stands out for its industry expertise, dedicated professionals, and transparent SWIFT code management. By ensuring the accuracy of your SWIFT details and partnering with a trusted institution, you can navigate global transactions with confidence. Let your funds move effortlessly across borders, connecting aspirations and opportunities worldwide.