In global financial transactions, ensuring funds reach the intended bank seamlessly hinges on a critical identifier: the SWIFT code (also known as a BIC code). For instance, the SWIFT code LNCBLYLT067 uniquely represents Libya’s NATIONAL COMMERCIAL BANK. This alphanumeric sequence not only authenticates the bank’s identity but also serves as the linchpin for cross-border transfers.

Decoding SWIFT: A Universal Identifier

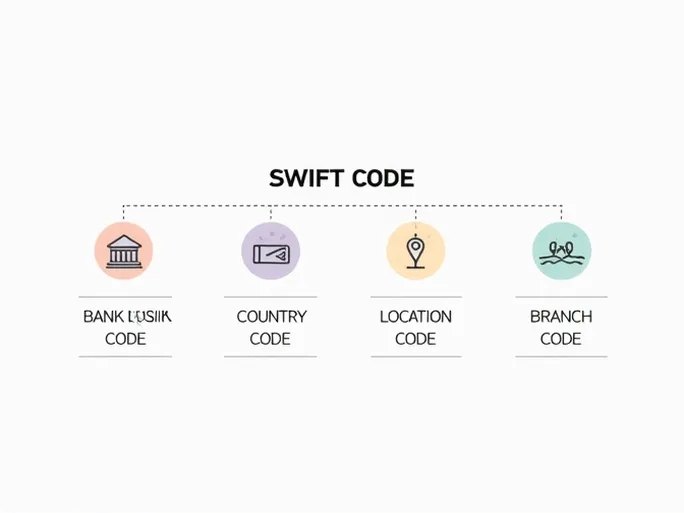

SWIFT codes are standardized identifiers assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to financial institutions worldwide. Each 8- to 11-character code is structured as follows:

- Bank Code (4 characters): Identifies the financial institution (e.g., LNCB for NATIONAL COMMERCIAL BANK).

- Country Code (2 characters): Denotes the bank’s location (e.g., LY for Libya).

- Location Code (2 characters): Specifies the city or region (e.g., LT ).

- Branch Code (3 characters, optional): Pinpoints a specific branch (e.g., 067 ).

Why Accuracy Matters

When initiating transfers to NATIONAL COMMERCIAL BANK, using the exact SWIFT code LNCBLYLT067 is nonnegotiable. Errors in this code can lead to delayed or misrouted funds, particularly in high-value or time-sensitive transactions. Financial institutions and individuals alike rely on these codes for:

- Processing international wire transfers.

- Receiving foreign currency payments.

- Facilitating trade finance and corporate transactions.

Navigating Fees and Requirements

While SWIFT codes standardize global transactions, fees and processing times vary by bank and country. Factors such as transfer purpose, amount, and intermediary banks may influence costs. Proactively verifying these details with involved institutions can mitigate unexpected charges.

Understanding SWIFT codes empowers both individuals and businesses to execute international transactions with confidence. In an era of interconnected finance, these identifiers are the silent guardians of efficiency and security.