In an increasingly globalized world, international trade and cross-border money transfers have become indispensable aspects of modern life. While the convenience of financial transactions has accelerated economic growth, the accompanying complexity cannot be overlooked. One of the most critical challenges in international transfers is ensuring the correct and secure use of SWIFT/BIC codes, with LNCBLYLT077 serving as the vital identifier for Libya's NATIONAL COMMERCIAL BANK.

Consider a scenario where an international transfer—whether for business expansion, a crucial project, or personal needs—must arrive promptly. A single error in financial documentation could delay funds for weeks or trigger costly returns. The solution lies in the precise use of SWIFT/BIC codes. For NATIONAL COMMERCIAL BANK, LNCBLYLT077 isn't just a random string; it's the linchpin connecting senders to the bank's international operations.

How SWIFT Codes Power Global Transactions

SWIFT codes function as a standardized communication system between financial institutions. Each 8- to 11-character code begins with the bank's unique identifier (e.g., LNCB for NATIONAL COMMERCIAL BANK), followed by country ( LY for Libya), location ( LT ), and an optional branch suffix ( 077 ). This structure ensures funds are routed accurately across borders.

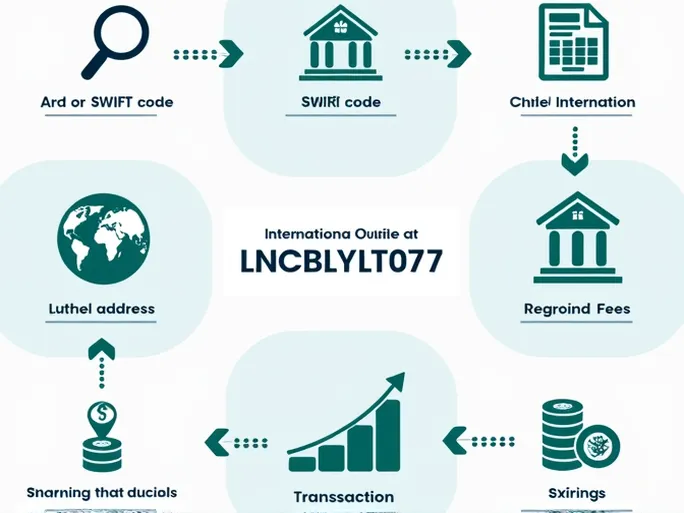

A Step-by-Step Guide to Secure Transfers

1. Verify the SWIFT Code

Always confirm the current SWIFT code before initiating transfers. While

LNCBLYLT077

is NATIONAL COMMERCIAL BANK's primary code, institutions occasionally update their identifiers. Cross-check through official bank channels to prevent processing failures.

2. Confirm Bank Details

Pair the SWIFT code with the recipient bank's full legal address. For NATIONAL COMMERCIAL BANK in Zawiya, Libya, this additional layer of verification minimizes routing errors. Incorrect addresses may trigger compliance reviews, delaying transactions.

3. Understand Fee Structures

International transfers often involve intermediary bank fees and exchange rate margins. Clarify all costs upfront—whether flat fees, percentage-based charges, or recipient-side deductions—to avoid unexpected reductions in the transferred amount.

4. Track Transaction Progress

Reputable banks provide reference numbers to monitor transfer status. This transparency allows senders to confirm when funds reach intermediary banks and when they're credited to the recipient's account, reducing anxiety about cross-border payment delays.

5. Conduct Periodic Security Reviews

For frequent senders, maintaining an updated database of SWIFT codes and banking contacts is essential. Financial institutions occasionally merge branches or upgrade systems, potentially invalidating previously used codes.

The Bigger Picture: Trust in Global Finance

Beyond technical functionality, SWIFT codes like LNCBLYLT077 represent the infrastructure enabling global economic interdependence. Each correctly executed transfer reinforces trust in international banking systems—a necessity for businesses scaling across borders and families supporting loved ones abroad.

As digital finance evolves, the precision required in using these identifiers remains constant. Whether you're a commercial entity or an individual user, mastering these details transforms international payments from a logistical hurdle into a strategic advantage.