In today's globalized financial markets, international money transfers have become a cornerstone for individuals and businesses engaging in cross-border transactions. However, ensuring that funds reach the intended bank account safely and efficiently remains a critical challenge. At the heart of this process lies the SWIFT/BIC code—a vital component that facilitates seamless international transactions. This article explores the significance and mechanics of the SWIFT/BIC code LNCBLYLT060 assigned to Libya's National Commercial Bank (NCB), providing essential guidance for users navigating international transfers.

1. Understanding SWIFT/BIC Codes

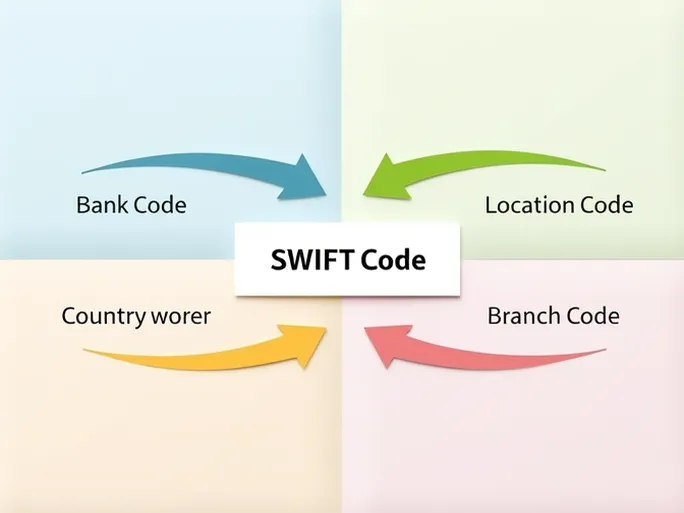

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) code, also known as the BIC (Bank Identifier Code), is a unique alphanumeric identifier assigned to banks and financial institutions worldwide. Comprising 8 to 11 characters, this code encapsulates key details about the bank, including its name, country, and location. The SWIFT network serves as a secure messaging system, enabling banks to transmit payment instructions and other financial information across borders.

2. Decoding the SWIFT/BIC Structure: LNCBLYLT060

The SWIFT code LNCBLYLT060 for Libya's National Commercial Bank can be dissected as follows:

- Bank Code (LNCB): The first four letters represent the bank's abbreviated name, clearly identifying it as the National Commercial Bank.

- Country Code (LY): The next two letters denote Libya, the bank's home country, as per the ISO 3166-1 alpha-2 standard.

- Location Code (LT): These two characters specify the bank's headquarters or primary office, often distinguishing it from other branches.

- Branch Code (060): The final three digits pinpoint a specific branch. If the code ends with "XXX," it typically refers to the bank's head office.

This structured breakdown ensures precision in cross-border transactions, minimizing errors and delays.

3. The Pivotal Role of SWIFT/BIC Codes in International Transfers

SWIFT/BIC codes are indispensable for the success of international money transfers. Whether for personal remittances, corporate payments, or investment transactions, the correct SWIFT code ensures funds are routed accurately. Key benefits include:

- Faster Processing: Accurate SWIFT codes expedite fund transfers, typically completing within 1–5 business days. Errors can cause unnecessary delays.

- Enhanced Security: Proper use of SWIFT codes reduces the risk of funds being misdirected to incorrect accounts.

- Simplified Transactions: Correct codes streamline cross-border payments, eliminating procedural complexities.

4. Verifying SWIFT/BIC Code Accuracy

Before initiating an international transfer, verifying the SWIFT code is crucial. Reliable methods include:

- Checking the bank's official website for published SWIFT/BIC details.

- Using the SWIFT organization's online database for validation.

- Consulting with your bank's customer service for confirmation.

5. Spotlight: National Commercial Bank and LNCBLYLT060

Libya's National Commercial Bank, headquartered in Zawia, operates with the SWIFT code LNCBLYLT060 . As one of Libya's largest financial institutions, NCB plays a pivotal role in domestic and international banking, offering diverse services to support economic growth.

- Bank Profile: Established in a dynamic regional financial landscape, NCB has grown into a key player with a robust portfolio of services.

- Transaction Security: NCB employs advanced technologies to safeguard transfers, ensuring client funds remain protected.

6. Common Misconceptions About SWIFT Codes

Misunderstandings about SWIFT/BIC codes can lead to transfer failures. Notable misconceptions include:

- Assuming SWIFT codes are adjustable—they are fixed identifiers assigned by SWIFT.

- Overlooking branch codes, which are critical for directing funds to specific accounts.

- Confusing SWIFT codes with IBANs (International Bank Account Numbers), which serve distinct purposes.

7. The Future of International Transfers

As financial technology evolves, SWIFT is adapting to innovations like blockchain-based transfers. While SWIFT/BIC codes remain foundational, upcoming trends include:

- Digital Transformation: Banks are increasingly adopting digital platforms to enhance cross-border payment efficiency.

- Greater Transparency: Real-time tracking of fund movements is becoming standard, improving user experience.

In conclusion, SWIFT/BIC codes like LNCBLYLT060 are indispensable tools for secure and efficient international banking. By understanding their structure and application, users can mitigate risks and optimize global financial transactions. As the financial landscape evolves, leveraging these identifiers—alongside emerging technologies—will remain vital for seamless cross-border commerce.