When making international wire transfers, selecting the correct SWIFT/BIC code is crucial for ensuring your funds reach their destination safely and promptly. This article examines the SWIFT code LNCBLYLT060 used by National Commercial Bank, explaining its structure, purpose, and proper usage scenarios.

The Structure and Function of SWIFT/BIC Codes

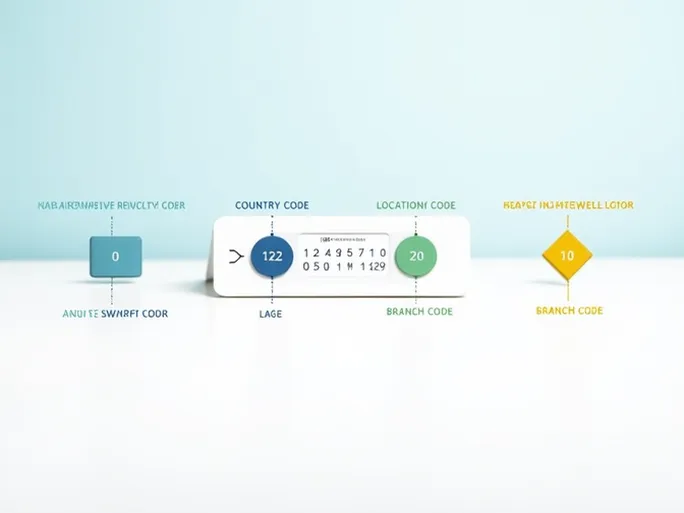

SWIFT/BIC codes typically consist of 8 to 11 alphanumeric characters that uniquely identify financial institutions worldwide. These codes serve as critical routing information for international transactions. The code LNCBLYLT060 breaks down as follows:

- LNCB : Bank identifier for National Commercial Bank

- LY : Country code for Libya

- LT : Location code indicating the bank's specific region

- 060 : Branch code identifying a particular office in Zawia city

When to Use LNCBLYLT060

The SWIFT code LNCBLYLT060 should be used for all international financial transactions directed to National Commercial Bank's Zawia branch. This includes:

- Cross-border wire transfers

- International payments

- Foreign currency exchanges

- Trade finance operations

Verifying the accuracy of this code before initiating any transaction is essential to prevent processing delays or misdirected funds.

Considerations for Multiple Branches

National Commercial Bank operates multiple branches that may use different SWIFT/BIC codes based on their location and services offered. Some branches specialize in retail banking while others focus on corporate financial services. When preparing an international transfer:

- Confirm the recipient's exact branch location

- Verify the correct SWIFT code with the recipient

- Double-check all transaction details before submission

The Importance of Code Accuracy

In today's globalized financial landscape, understanding SWIFT/BIC codes has become increasingly important. Using the correct code—LNCBLYLT060 for National Commercial Bank's Zawia branch—ensures efficient processing of international transactions while minimizing potential complications.

Errors in SWIFT codes can lead to significant delays in fund transfers and, in some cases, may result in financial losses. Always carefully review all transaction details to facilitate smooth and secure money transfers across borders.