In an era of rapid globalization, international bank transactions have become routine for both individuals and businesses. Among the critical elements for successful cross-border transactions is understanding SWIFT/BIC codes. These codes serve as the foundation for interbank communication and ensure the secure transfer of funds worldwide. This article examines SWIFT/BIC codes in detail, with a focus on the National Commercial Bank in Libya (code: LNCBLYLTXXX), and explores how to leverage these codes effectively for international transactions.

Understanding SWIFT/BIC Codes and Their Significance

SWIFT codes (also called BIC codes) are unique identifiers used to recognize financial institutions in global transactions. Developed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), this system provides a standardized method for secure electronic communication between banks. A SWIFT/BIC code typically consists of 8 to 11 characters, comprising a bank code, country code, location code, and optional branch code. This standardization ensures accurate and efficient international fund transfers while minimizing transaction risks.

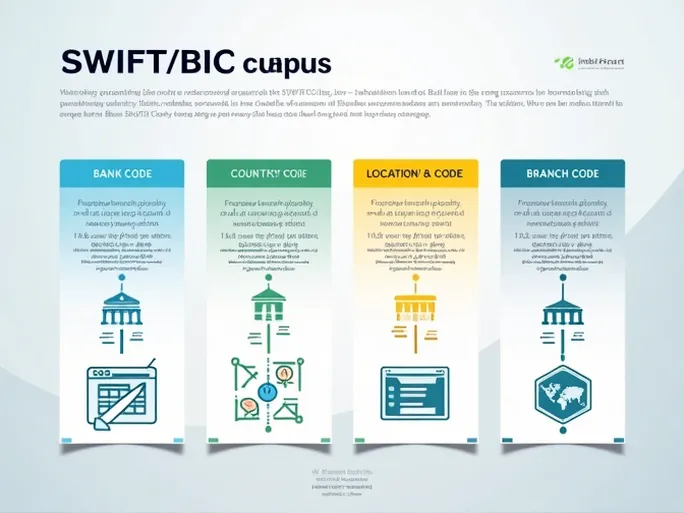

Anatomy of a SWIFT/BIC Code

The SWIFT/BIC code can be broken down into four distinct components:

- Bank Code (4 letters): Identifies the specific financial institution (e.g., "LNCB" for National Commercial Bank).

- Country Code (2 letters): Indicates the bank's home country ("LY" for Libya).

- Location Code (2 characters): Specifies the bank's headquarters or branch location ("LT").

- Branch Code (3 characters, optional): Identifies specific branches ("XXX" typically denotes the head office).

The complete code LNCBLYLTXXX thus represents a standardized identifier that ensures consistency and reliability in international banking operations.

National Commercial Bank: An Overview

Institutional Profile

Established in 1970, National Commercial Bank (NCB) stands as one of Libya's primary financial institutions. The bank offers comprehensive financial services to both individual and corporate clients, maintaining significant influence in domestic and international markets while continuously expanding its network and service offerings.

Financial Products and Services

NCB provides a diverse range of banking solutions, including:

- Savings and checking accounts

- Loan and financing products

- Domestic and international remittance services

- Foreign exchange operations

- Insurance products

Through its advanced digital banking platforms, NCB enables customers to conduct transactions efficiently from anywhere in the world.

Practical Applications of SWIFT/BIC Codes

Executing International Transactions

When initiating an international transfer, follow these steps:

- Obtain the recipient bank's SWIFT/BIC code

- Complete the transfer form with accurate account details and the SWIFT code

- Verify the transaction amount and currency

- Submit the request through digital banking channels or in person

- Monitor the transaction status using tracking services

Key Considerations

Important factors to remember when using SWIFT/BIC codes:

- Precision is critical - even minor errors can prevent successful transfers

- Transaction fees vary by bank, amount, and destination

- Exchange rate fluctuations may affect the final transfer value

Security Measures and System Evolution

The SWIFT network continuously enhances its security protocols to address emerging financial threats. Current safeguards include:

- Advanced message authentication to prevent fraudulent transactions

- Comprehensive monitoring systems to detect suspicious activity

- Educational programs to improve institutional compliance and security

Future Perspectives

While emerging technologies like blockchain may transform international banking, SWIFT/BIC codes remain essential infrastructure. As financial institutions prioritize transparency and efficiency, these standardized identifiers will continue to play a vital role in global transactions.

Conclusion

SWIFT/BIC codes represent a cornerstone of international finance, with codes like LNCBLYLTXXX for National Commercial Bank ensuring secure and efficient cross-border transactions. By mastering these identifiers and their proper use, individuals and businesses can navigate global financial markets with greater confidence and effectiveness.