In today's globalized economy, international financial transactions have become an integral part of daily life for many individuals. Whether for business travel, studying abroad, or maintaining connections with friends and family overseas, the need for cross-border money transfers continues to grow. However, as demand increases, many consumers encounter challenges when conducting international transactions, particularly when dealing with SWIFT codes.

Understanding SWIFT Codes

SWIFT codes, officially known as Bank Identifier Codes (BIC), serve as unique identifiers for financial institutions in international transactions. These codes typically consist of 8 to 11 characters, each segment providing specific information:

- First 4 characters: Bank code (identifying the financial institution)

- Next 2 characters: Country code (ISO country designation)

- Following 2 characters: Location code (identifying the city)

- Final 3 characters (optional): Branch code (specific office identification)

For example, the SWIFT code LNCBLYLT XXX belongs to National Commercial Bank in Libya. This breakdown demonstrates how each component contributes to precise financial routing.

The Role of National Commercial Bank

Headquartered in Al Bayda, Libya, with its main office at NCB Building, Urouba Street, National Commercial Bank serves as a crucial financial hub. As one of Libya's largest banking institutions, it facilitates both domestic services and international capital flows. The bank's SWIFT code functions as a precise navigation tool, ensuring funds reach their intended destination efficiently.

Executing International Transfers

When initiating an international money transfer, several critical steps ensure successful completion:

- Confirm the recipient's country and banking institution

- Obtain and verify the correct SWIFT/BIC code

- Provide complete recipient details (full name, account number, address)

- Review all transaction information before submission

Accuracy in providing the SWIFT code proves particularly vital. Even minor errors can result in delayed, misdirected, or returned transfers. When uncertain about code accuracy, contacting the recipient's bank directly for confirmation remains the most reliable approach.

Security Considerations in Digital Transactions

As international money transfers increasingly shift toward digital platforms, security concerns grow proportionally. While electronic banking offers convenience, it also introduces potential vulnerabilities. Implementing robust security measures becomes essential:

- Use strong, unique passwords for banking accounts

- Enable two-factor authentication where available

- Verify website security before entering sensitive information

- Monitor transaction confirmations and account statements

The Global Financial Infrastructure

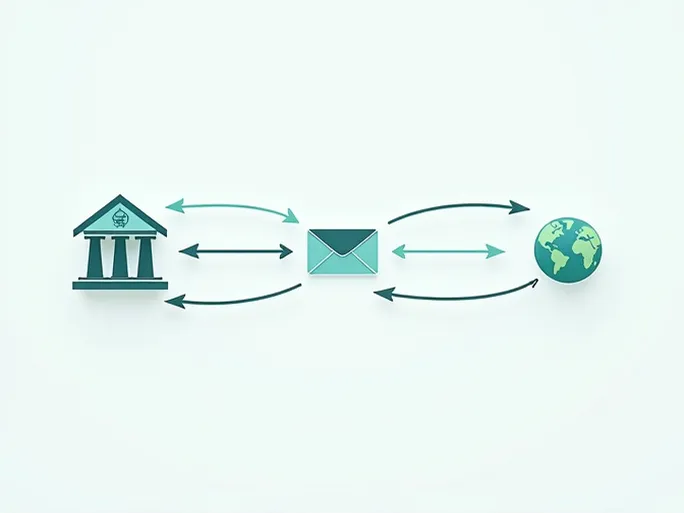

Beyond its technical function, the SWIFT system represents a cornerstone of international finance. This global messaging network enables secure information exchange between financial institutions worldwide, facilitating efficient cross-border transactions. The widespread adoption of standardized codes like LNCBLYLT XXX reflects deepening financial globalization and institutional cooperation across nations.

Practical Considerations for Consumers

For individuals navigating international transfers, several practical factors warrant attention:

- Transaction fees vary significantly between providers

- Processing times differ by destination and service level

- Exchange rates impact the final received amount

- Banking hours may affect processing timelines

Understanding these variables allows for informed decision-making when selecting transfer methods and financial institutions. While SWIFT code accuracy remains paramount, considering total costs and transfer speeds contributes to optimal transaction outcomes.