In today's globalized financial landscape, cross-border remittances have become an essential part of modern life. When sending money internationally, ensuring the safe and efficient delivery of funds requires understanding one crucial element: the SWIFT code. For transactions involving Libya's NATIONAL COMMERCIAL BANK, the SWIFT code LNCBLYLT054 serves as this critical identifier.

What Is a SWIFT Code?

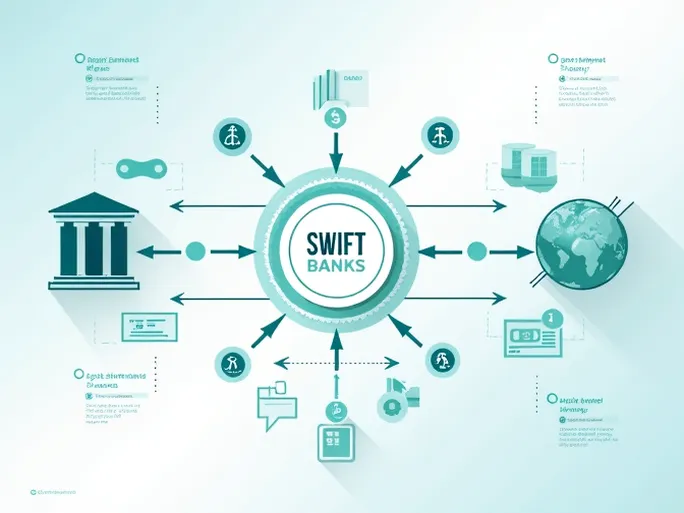

A SWIFT code, also known as a Bank Identifier Code (BIC), is an essential labeling system for international banking transactions. This 8-to-11 character alphanumeric code uniquely identifies specific financial institutions and their locations. During international transfers, SWIFT codes serve as precise routing instructions, enhancing both the efficiency and security of cross-border payments.

The Purpose and Function of SWIFT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), established in 1973 and headquartered in Brussels, Belgium, operates a secure messaging network that facilitates global financial communications. Its primary functions include:

- Secure messaging between financial institutions

- Processing cross-border payments with efficiency and reliability

- Providing confirmation services for international transactions including remittances and trade finance

By standardizing communication between banks worldwide, the SWIFT network reduces errors and processing delays while increasing the efficiency of global commerce.

Decoding NATIONAL COMMERCIAL BANK's SWIFT: LNCBLYLT054

As one of Libya's primary financial institutions, NATIONAL COMMERCIAL BANK offers comprehensive services ranging from personal banking to commercial finance and investment solutions. The bank's SWIFT code breaks down as follows:

- Bank Code (LNCB): The unique identifier for NATIONAL COMMERCIAL BANK

- Country Code (LY): Designates Libya as the destination country

- Location Code (LT): Identifies the bank's headquarters location

- Branch Code (054): Specifies a particular branch (optional)

Using an incorrect SWIFT code may result in delayed transfers, lost funds, or potential fraud. Always verify the recipient's SWIFT code before initiating any international transaction.

When to Use LNCBLYLT054

This specific SWIFT code becomes essential when:

- Processing international trade payments to Libyan businesses

- Sending personal remittances to accounts held at NATIONAL COMMERCIAL BANK

- Transferring investment proceeds from Libyan assets

Before initiating transfers, confirm current exchange rates, applicable fees, and estimated processing times with your financial institution.

International Transfer Process and Considerations

Cross-border payments typically involve these key steps:

- Selecting a transfer provider (banks, digital platforms, or specialized services)

- Accurately completing all required information including the recipient's full banking details

- Understanding and approving all applicable charges

- Retaining transaction confirmation documents

- Monitoring the transfer status through available tracking systems

Security Measures for International Transfers

To mitigate risks when sending money abroad:

- Verify all recipient details through multiple sources

- Utilize services offering two-factor authentication

- Regularly review account statements for unauthorized activity

- Maintain updated cybersecurity protections on digital banking platforms

- Never share sensitive financial information with unverified parties

As global financial integration continues to deepen, understanding systems like SWIFT codes becomes increasingly important for both individuals and businesses engaged in cross-border transactions. Proper use of these financial identifiers helps ensure smooth, secure movement of funds across international borders.