In today's globalized financial landscape, international money transfers have become a vital link connecting individuals and businesses worldwide. However, many may not realize how crucial the correct SWIFT/BIC code is when conducting cross-border transactions. This 8 to 11-character code not only identifies banks and their branches but also plays a pivotal role in ensuring fund security and successful transfers.

Understanding SWIFT/BIC Codes

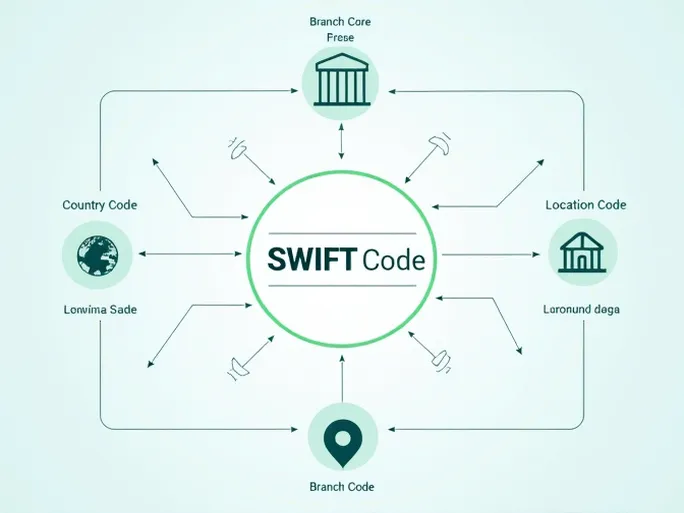

SWIFT/BIC codes serve as unique identifiers for specific banks and their branches worldwide. Taking the example code LNCBLYLT053, we can analyze its structure to better understand how these identifiers work:

- Bank Code (LNCB): The first four characters represent NATIONAL COMMERCIAL BANK.

- Country Code (LY): The subsequent two letters indicate the bank's location in Libya.

- Location Code (LT): The next two characters pinpoint the bank's specific location.

- Branch Code (053): The final three digits identify the particular branch.

When a SWIFT code ends with "XXX," this typically refers to a bank's head office rather than a specific branch.

Why SWIFT Codes Matter

Using the correct SWIFT code is absolutely critical for international money transfers. Key considerations include:

- Bank Verification: Always confirm that the bank name matches the recipient's bank exactly to prevent selection errors.

- Branch Accuracy: When using a branch-specific SWIFT code, ensure it corresponds with the recipient's branch.

- Country Consistency: The country code within the SWIFT must align with the recipient bank's location.

Following these steps significantly reduces potential transfer issues, delays, and unnecessary financial losses.

Selecting a Transfer Service

When transferring funds to NATIONAL COMMERCIAL BANK, choosing a reliable service provider is essential. Some platforms may offer more favorable exchange rates and lower fees compared to traditional banks, providing cost-effective solutions with transparent pricing structures.

Additionally, certain services can process most transfers within shorter timeframes, ensuring faster fund availability. Given the time-sensitive nature of financial transactions, selecting an efficient provider becomes particularly important.

For those encountering difficulties or uncertainties during the SWIFT transfer process, consulting with financial professionals can provide valuable guidance. Specialized services offer personalized support to help ensure smooth and successful transactions.

Ultimately, proper use of SWIFT/BIC codes remains fundamental to successful international money transfers. By carefully verifying bank details, understanding code structures, and selecting appropriate transfer services, individuals and businesses can avoid unnecessary complications and expenses while streamlining their global financial operations.