In international financial transactions, SWIFT/BIC codes serve as both security guardians and essential facilitators of capital movement. Examining the structure of these codes—using NATIONAL COMMERCIAL BANK's SWIFT/BIC code LNCBLYLT064 as an example—can help prevent unnecessary delays and complications during fund transfers.

Anatomy of a SWIFT/BIC Code

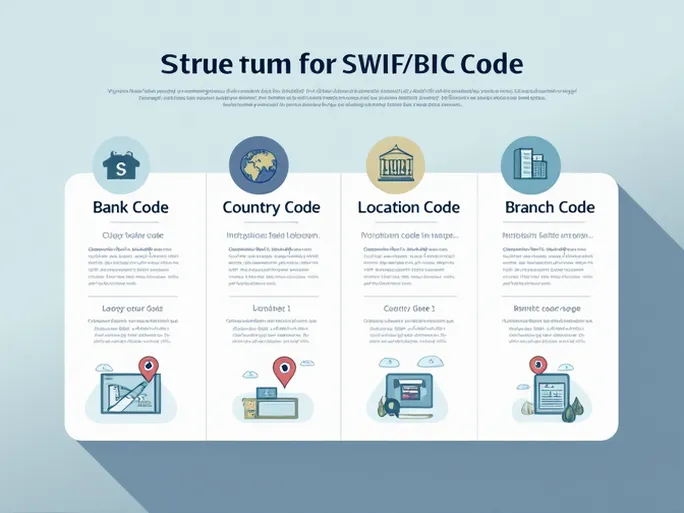

Comprising 8 to 11 characters, SWIFT/BIC codes follow this standardized structure:

- Bank Code (LNCB): A four-letter identifier representing NATIONAL COMMERCIAL BANK, enabling immediate financial institution recognition.

- Country Code (LY): The two-letter ISO country designation (Libya in this instance).

- Location Code (LT): Two characters pinpointing the bank's specific geographic operation.

- Branch Code (064): Three digits identifying a particular branch. The "XXX" suffix denotes a bank's headquarters.

Ensuring Proper SWIFT/BIC Code Implementation

When transferring funds to NATIONAL COMMERCIAL BANK or any international institution, meticulous verification of transfer details prevents transactional failures:

- Institution Verification: Cross-check the recipient bank's registered name against your transaction records.

- Branch Specificity: When using branch-specific codes, confirm the exact branch location matches the recipient's account details.

- Geographic Accuracy: Validate that the country code corresponds with the recipient bank's operational jurisdiction.

Optimizing International Transfers

Modern financial services offer significant advantages for cross-border transactions:

- Competitive Exchange Rates: Specialized providers frequently offer more favorable rates than traditional banking institutions.

- Fee Transparency: Reputable platforms provide complete cost breakdowns before transaction confirmation.

- Expedited Processing: Many transactions complete within the same business day, addressing time-sensitive financial needs.

Financial institutions maintain dedicated support teams to assist with SWIFT-related inquiries, ensuring smooth international fund movement.

Conclusion

In our interconnected global economy, proper understanding and implementation of SWIFT/BIC protocols enhances transactional efficiency while mitigating financial risks. These standardized codes remain fundamental to secure, efficient international capital movement.