In today's globalized financial landscape, international money transfers have become a crucial aspect of both personal and business operations. Whether conducting cross-border transactions or transferring personal funds, one of the key elements in ensuring successful transfers is the accurate use of SWIFT codes. These codes serve as the universal language of financial transactions and the backbone of interbank communication worldwide.

Understanding SWIFT Codes

SWIFT codes, formally known as Bank Identifier Codes (BIC), are standardized identifiers created by the Society for Worldwide Interbank Financial Telecommunication. These 8 to 11-character codes uniquely identify banks and their branches in the global financial system. The structure of a SWIFT code provides essential information about the financial institution and its location, significantly enhancing transaction efficiency and security while minimizing transfer errors.

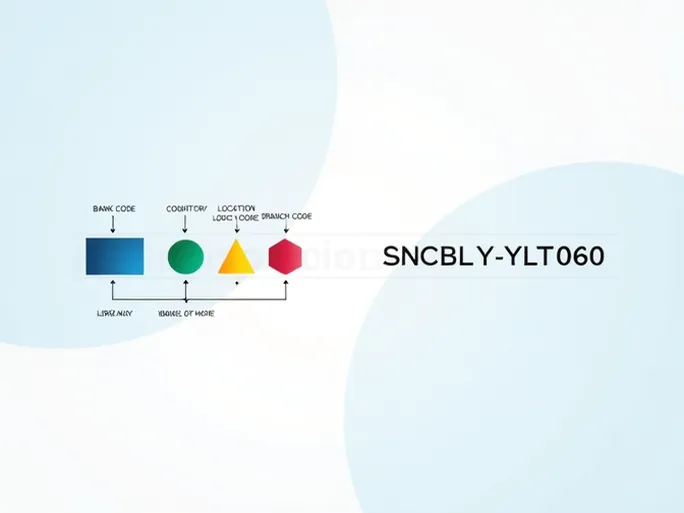

The standard SWIFT code structure consists of:

- Bank code (4 letters): Identifies the specific financial institution

- Country code (2 letters): Uses ISO 3166-1 alpha-2 country designation

- Location code (2 characters): Specifies the bank's primary location

- Branch code (optional 3 characters): Identifies specific branches (XXX typically denotes the head office)

Decoding LNCBLYLT060

The SWIFT code LNCBLYLT060 belongs to National Commercial Bank. Breaking down its components reveals important information for international transfers:

- Bank code (LNCB): Represents National Commercial Bank's unique identifier

- Country code (LY): Indicates Libya as the bank's home country

- Location code (LT): Specifies the bank's primary location or headquarters

- Branch code (060): Identifies a specific branch within the bank's network

Each segment of this SWIFT code plays a critical role in ensuring accurate routing of international payments. Understanding these components helps prevent transfer delays, failures, or misdirected funds.

Practical Application: Transferring Funds

Consider a scenario where you need to send $10,000 to an account at National Commercial Bank. The following steps outline the transfer process:

- Select a transfer service: Compare platforms based on exchange rates, fees, and transfer speed. Services offering transparent fee structures and competitive rates are preferable.

- Complete recipient details: Accurately input the beneficiary's full name, address, and the SWIFT code LNCBLYLT060. Even minor errors in the SWIFT code can cause transfer failures.

- Verify currency conversion: Confirm the exchange rate applied to your transfer amount. For example, at an exchange rate of 1 USD to 0.8492 EUR, your $10,000 would convert to approximately €8,492.

- Monitor the transfer: Utilize tracking tools provided by your chosen service to follow the payment's progress until completion.

Key Considerations for International Transfers

When initiating cross-border payments, several critical factors require attention:

- Verify all bank details, including the exact SWIFT code and recipient information

- Confirm whether the SWIFT code corresponds to a specific branch or the head office

- Double-check the country code matches the recipient bank's location

- Maintain complete records of the transaction for future reference

SWIFT codes like LNCBLYLT060 serve as vital identifiers in the global financial network. Their proper use ensures efficient, secure international money transfers, facilitating seamless cross-border financial operations for individuals and businesses alike.