In today’s interconnected financial networks, international wire transfers have become a cornerstone of economic activity for individuals and businesses alike. As markets grow increasingly globalized, the ability to transfer funds swiftly and accurately has emerged as a critical concern. At the heart of this process lies the SWIFT code—a unique identifier for each bank—that ensures seamless cross-border transactions. This article focuses on INTESA SANPAOLO SPA, one of Italy’s most prominent financial institutions, and explores how using its correct SWIFT code, BCITITMM 071 , safeguards the efficiency of your international transfers.

Understanding INTESA SANPAOLO SPA’s SWIFT Code

INTESA SANPAOLO SPA embodies Italy’s tradition of stability and innovation in banking. As one of the country’s largest commercial banks, it boasts a robust financial services ecosystem and a vast customer base. For international transfers, the bank’s SWIFT code is indispensable to ensure funds reach their destination accurately and without delay. The code BCITITMM 071 is a critical piece of information for every transaction involving this institution.

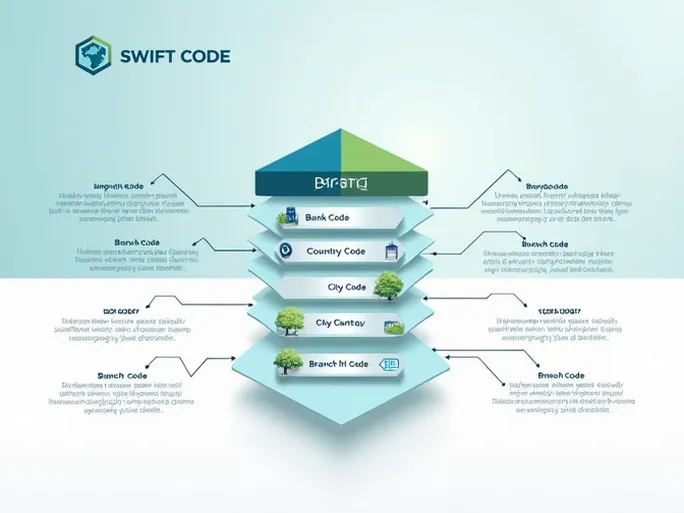

Decoding the SWIFT Code: BCITITMM 071

Each segment of the SWIFT code serves a specific purpose in the global banking network:

- Bank Code (BCIT) : Identifies INTESA SANPAOLO SPA, enabling other financial institutions to recognize the recipient bank instantly.

- Country Code (IT) : Denotes Italy, clarifying the origin and destination of the funds within the international financial system.

- Location Code (MM) : Specifies the bank’s geographic location, enhancing transaction precision.

- Branch Code (071) : Directs funds to a specific branch, minimizing errors or delays caused by misrouting.

This structured format ensures seamless coordination across global financial networks, guaranteeing that funds are delivered to the intended account without hiccups.

An Overview of INTESA SANPAOLO SPA

1. Background and Reputation

Founded in 2007 through the merger of two leading Italian banks, INTESA SANPAOLO SPA was designed to thrive in an evolving global financial landscape. Today, it operates an extensive network of domestic and international branches, offering services spanning commercial banking, investment banking, asset management, and insurance. Its comprehensive suite of financial products caters to diverse client needs, solidifying its reputation as a trusted institution.

2. Range of Services

Beyond traditional savings and lending services, INTESA SANPAOLO SPA provides investment advisory, financial planning, and securities trading. Its corporate banking division excels in offering tailored solutions, including financing, foreign exchange, and trade services. For international clients, the bank delivers customized cross-border financial strategies, facilitating smooth global operations. Whether executing routine transfers or complex multinational transactions, INTESA SANPAOLO SPA provides reliable support at every step.

Why Use BCITITMM 071?

Using the correct SWIFT code for INTESA SANPAOLO SPA isn’t just about ensuring successful transfers—it’s about safeguarding the security, timeliness, and accuracy of your funds. Errors in the SWIFT code can lead to:

- Delays : Transfers may take significantly longer to process, disrupting time-sensitive transactions.

- Additional Fees : Some banks charge extra for failed or misdirected transfers.

- Lost Funds : In rare cases, incorrect codes may result in funds being deposited into the wrong account, with potential financial repercussions.

To mitigate these risks, always verify the SWIFT code before initiating a transfer.

How to Initiate an International Transfer with INTESA SANPAOLO SPA

1. Open an Account

To send or receive international wires, you’ll need an account with INTESA SANPAOLO SPA. This can be done online, via the bank’s mobile app, or in person at a branch. Required documents typically include proof of identity and residency.

2. Gather Recipient Details

Before transferring funds, compile the recipient’s banking information, including the SWIFT code ( BCITITMM 071 ), full account number, and personal details (name, address). Accuracy here is paramount.

3. Select a Transfer Method

The bank offers multiple options: online banking, mobile app transfers, or in-person requests at a branch. Choose the most convenient method for your needs.

4. Complete the Transfer Form

When filling out the form, double-check the SWIFT code and all other details. Clarity and precision reduce the likelihood of errors.

5. Verify and Submit

Review the transfer amount, recipient information, and SWIFT code before submission. Online transactions often generate a confirmation email or notification for your records.

INTESA SANPAOLO SPA’s Global Footprint

As a leading European bank, INTESA SANPAOLO SPA holds significant influence not only in Italy but also across international markets, particularly in Europe and the Middle East. Its diversified operations—encompassing retail, commercial, and private banking—reinforce its competitive edge in global finance.

Security Measures and Risk Management

Given the complexities of cross-border transactions, INTESA SANPAOLO SPA prioritizes fund security through advanced protocols:

1. Encryption Technology

State-of-the-art encryption protects every transaction, shielding clients from cyber threats and unauthorized access.

2. Real-Time Monitoring

The bank employs 24/7 surveillance systems to detect and respond to suspicious activity, significantly reducing fraud risks.

Customer Support and Experience

INTESA SANPAOLO SPA enhances user satisfaction through personalized services:

1. Dedicated Helpline

Clients can access round-the-clock assistance via phone, website, or mobile app for any transfer-related queries.

2. Multilingual Support

To accommodate international clients, the bank offers services in multiple languages, ensuring smooth communication.

Final Thoughts

In international banking, the correct SWIFT code is the linchpin of successful transfers. INTESA SANPAOLO SPA’s expertise, expansive services, and global reach make it a dependable choice for individuals and businesses alike. By using BCITITMM 071 , you can streamline your transactions, ensuring security and efficiency in every transfer. With a commitment to innovation and client satisfaction, INTESA SANPAOLO SPA continues to set benchmarks in the financial sector, empowering users to navigate global markets with confidence.