When conducting international money transfers, many individuals find themselves perplexed by the concept of SWIFT codes. However, the correct use of these codes is as crucial as selecting the appropriate banking institution. A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric sequence used to identify specific banks and their branches in global financial transactions. Among the numerous participants in the international banking system, Intesa Sanpaolo SPA stands out as a prominent example. Its SWIFT/BIC code, BCITITMM071, represents vital information for anyone initiating transfers to this institution.

Understanding Intesa Sanpaolo SPA

Headquartered in Milan, Italy at Palazzo B 7 Floor 5, Strada Milanofiori 3, Assago, MI 20090, Intesa Sanpaolo SPA was established in 2007 through the merger of two major Italian banks - Sanpaolo IMI and Intesa BCI. This consolidation created Italy's largest retail bank and positioned the institution as a significant player in European financial markets. With substantial financial resources and extensive experience, the bank offers comprehensive services including personal banking, commercial banking, and wealth management solutions to clients worldwide.

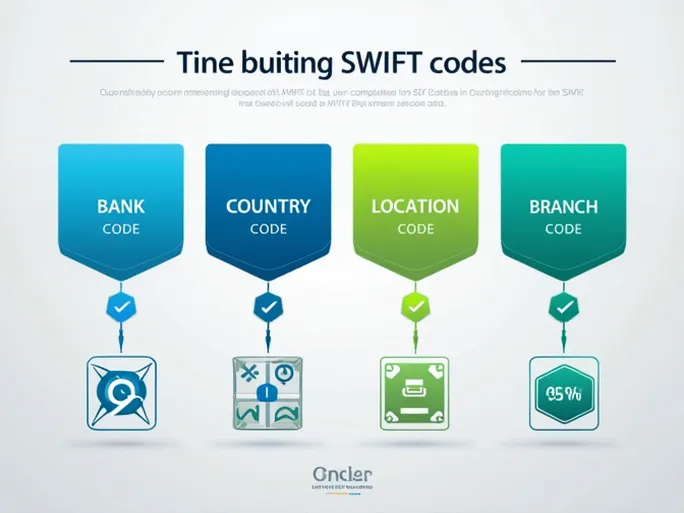

The Structure and Importance of SWIFT Codes

SWIFT codes serve the critical function of ensuring accurate routing of funds to intended recipients. Each code consists of 8 to 11 characters that identify:

- The bank (BCIT for Intesa Sanpaolo)

- The country (IT for Italy)

- The location (MM for Milan)

- The specific branch (071 in this case)

Given that international transfers involve multiple currencies and banking systems, correct SWIFT code usage prevents errors and minimizes processing delays. Incorrect codes may result in failed transactions, requiring additional time and expense to resolve. Therefore, verifying the accuracy of SWIFT information before initiating transfers remains essential.

Additional Considerations for International Transfers

Beyond confirming SWIFT codes, senders should account for other variables:

- Varying fee structures among financial institutions

- Differing processing times across countries and banks

- Exchange rate fluctuations and associated costs

When using Intesa Sanpaolo for international transactions, clients should consult the bank for current fee schedules and exchange rate information to ensure transparency and efficiency.

Best Practices for Secure Transfers

To safeguard transactions, financial experts recommend:

- Directly confirming SWIFT/BIC codes with recipients

- Utilizing bank-provided online transfer services where available

- Regularly reviewing updated international transfer policies on bank websites

- Consulting customer service representatives for clarification on procedures

These measures enhance transaction security while improving the likelihood of successful fund transfers.

In an increasingly interconnected global economy, understanding international banking protocols has become essential. Proper use of SWIFT codes, particularly when conducting business with major institutions like Intesa Sanpaolo, facilitates smooth cross-border financial operations and minimizes potential complications.