In today's globalized economy, cross-border payments have become an integral part of daily life. Whether for settling international bills, supporting family members abroad, or conducting business transactions, ensuring the security and efficiency of these transactions is paramount. The SWIFT/BIC code plays a critical role in this process.

The Basics of SWIFT/BIC Codes

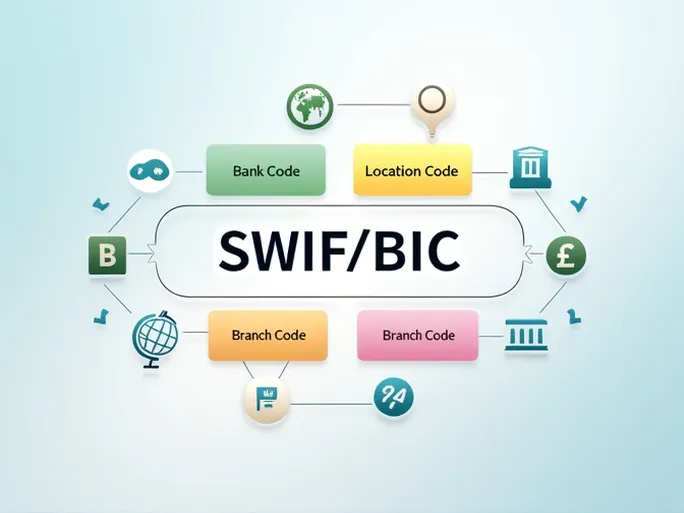

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a secure network that facilitates financial messaging between banks. The SWIFT/BIC (Bank Identifier Code) is a unique identifier used within this network to pinpoint specific financial institutions. Typically, this code consists of 8 to 11 characters, structured as follows:

- Bank Code (4 letters): Represents the bank's name. For example, "BCIT" refers to Intesa Sanpaolo SPA.

- Country Code (2 letters): Follows the ISO 3166-1 standard to indicate the bank's country. "IT" stands for Italy.

- Location Code (2 characters): Identifies the bank's city or headquarters.

- Branch Code (3 digits, optional): Specifies a particular branch. "XXX" denotes the bank's head office.

Example: Intesa Sanpaolo SPA's SWIFT/BIC Code

For Intesa Sanpaolo SPA, the complete SWIFT/BIC code is BCITITMM071 , where:

- "BCIT" identifies the bank.

- "IT" represents Italy.

- "MM071" specifies the branch location.

Why SWIFT Codes Matter

Using the correct SWIFT code is essential for international transfers. Errors can lead to delays or misdirected funds, causing financial losses and operational headaches. Key verification steps include:

- Confirming the recipient bank’s exact SWIFT code.

- Checking whether a branch-specific code is required.

- Ensuring the country code matches the destination.

The Cross-Border Payment Process

International transfers typically involve:

- Verifying the recipient’s bank details, including the SWIFT code.

- Selecting a service provider (e.g., traditional banks or digital platforms).

- Submitting the transfer request and paying associated fees.

- Reviewing the transaction confirmation.

- Tracking the transfer’s progress using the SWIFT code.

- Confirming receipt by the beneficiary.

Advantages of Digital Payment Solutions

Digital platforms offer distinct benefits over traditional banks for international transfers:

- Competitive Exchange Rates: Often more favorable than bank-offered rates, especially for large transfers.

- Transparent Fees: Clear, upfront pricing without hidden charges.

- Speed: Many transactions are completed within the same day.

- 24/7 Support: Round-the-clock assistance for troubleshooting.

Conclusion

Understanding SWIFT/BIC codes is fundamental to executing secure and accurate international payments. Coupled with a reliable service provider, this knowledge ensures seamless cross-border transactions, whether for personal or business purposes. As global financial interactions grow increasingly complex, informed choices and meticulous verification remain indispensable.