When sending money internationally, knowing the correct SWIFT/BIC code is essential. This unique identifier, consisting of 8 to 11 characters, is used to pinpoint specific banks and their branches worldwide. Using BGFIBANK as an example, we break down the structure of its SWIFT/BIC code— BGFIGALIBKZ —and explain why accuracy matters.

Decoding the SWIFT/BIC Structure

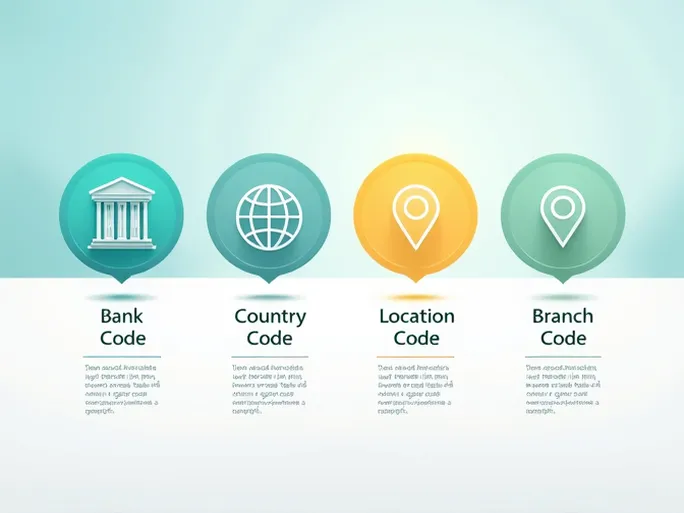

The SWIFT/BIC code BGFIGALIBKZ is composed of four distinct parts:

- Bank Code (BGFI): The first four characters identify BGFIBANK as the financial institution.

- Country Code (GA): The following two letters denote the bank’s home country, Gabon.

- Location Code (LI): These two characters specify the bank’s headquarters.

- Branch Code (BKZ): The final three characters indicate a specific branch. If the code ends with "XXX," it refers to the bank’s primary office.

Thus, BGFIBANK’s full SWIFT/BIC code is BGFIGALIBKZ , while the shortened version (without branch details) is BGFIGALI .

Why Accuracy Matters

Using the correct SWIFT/BIC code prevents delays and errors in international transfers. Before initiating a transaction, verify the following:

- Bank Name: Confirm that the recipient’s bank name matches the SWIFT code to avoid misdirected funds.

- Branch Details: If using a branch-specific code, ensure the recipient’s account is held at that location.

- Country Alignment: SWIFT codes are country-specific; double-check that the code corresponds to the recipient’s bank location.

Efficiency in International Transfers

Timeliness is critical for cross-border payments. Unlike traditional banks, which may process transfers over several days, specialized services often complete transactions within the same business day. Ensuring the correct SWIFT/BIC code is used streamlines the process, saving both time and costs.

Understanding and correctly applying SWIFT/BIC codes like BGFIGALIBKZ guarantees smooth transactions, minimizing disruptions and maximizing efficiency in global money transfers.