In the realm of global financial transactions, using the correct SWIFT/BIC code is essential to ensure the security and efficiency of fund transfers. Examining the code DABAFIHHCLS provides insight into its structure and how this information facilitates seamless international transactions.

Understanding the SWIFT/BIC Code Structure

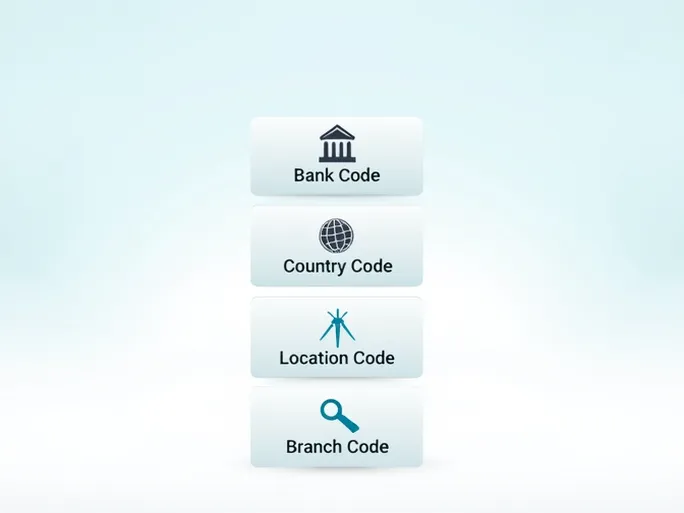

A SWIFT/BIC code consists of 8 to 11 characters, uniquely identifying a specific bank and its branch worldwide. Taking DABAFIHHCLS as an example:

DABA represents the bank code, identifying DANSKE BANK A/S, FINLAND BRANCH . The following two characters, FI , denote the country code, confirming the bank’s location in Finland.

The next two characters, HH , serve as the location code, indicating the bank’s headquarters. The final three characters, CLS , specify the branch. If a SWIFT code ends with XXX , it typically refers to the bank’s primary office.

The Critical Role of Accurate SWIFT Codes

Using the correct SWIFT/BIC code, such as DABAFIHHCLS , is vital for international transfers. Errors in the code can lead to delays or misdirected funds, increasing transaction risks. As cross-border financial activities grow, verifying the accuracy of SWIFT codes becomes even more crucial to avoid complications.

Ultimately, understanding and correctly applying SWIFT/BIC codes enhances the efficiency of financial transactions while providing an additional layer of security for clients.