When sending or receiving international wire transfers, using the correct SWIFT code significantly reduces transaction errors and ensures funds reach the intended account securely. For Barclays Bank UK PLC, the SWIFT code BUKBGB22SEC is critical for successful transactions. This guide explains the composition, function, and proper usage of SWIFT codes to facilitate seamless international money transfers.

Understanding SWIFT Codes

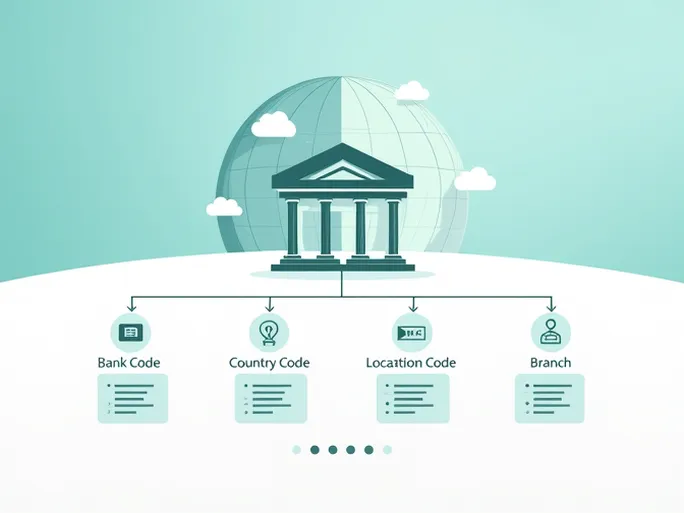

SWIFT codes, also known as Bank Identifier Codes (BIC), consist of 8 to 11 alphanumeric characters that uniquely identify financial institutions worldwide. These codes serve as essential routing information for international wire transfers, guaranteeing that funds move accurately from the sender's bank to the recipient's bank.

Decoding Barclays Bank's SWIFT: BUKBGB22SEC

The official SWIFT code for Barclays Bank UK PLC breaks down into four distinct components:

- BUKB : The bank code representing Barclays Bank

- GB : The country code for the United Kingdom

- 22 : The location code for London

- SEC : The branch identifier, typically denoting specific services or departments

Using this precise code ensures funds are routed correctly to Barclays Bank accounts. Whether transferring to personal, business, or institutional accounts, accurate SWIFT code usage remains fundamental for successful transactions.

Step-by-Step Guide to International Wire Transfers

When initiating an international transfer, you'll need the recipient's complete banking details, including their bank name, address, SWIFT code, and account number. Follow these steps for a smooth transaction:

- Verify information : Double-check all details, especially the SWIFT code and account number

- Select transfer method : Choose between bank transfers, online platforms, or specialized money transfer services

- Complete transfer form : Input the recipient's details including the SWIFT code BUKBGB22SEC

- Review fees and exchange rates : Compare transfer costs and currency conversion rates across providers

- Submit and confirm : Finalize the transaction and retain confirmation details

Exchange Rates and Transfer Fees

International transfers involve two key financial considerations: exchange rates and transaction fees. The applied exchange rate often differs from mid-market rates, potentially affecting the final amount received. Comparing providers can help secure favorable terms for both exchange rates and transfer fees.

Key Takeaways

Proper use of the SWIFT code BUKBGB22SEC ensures efficient and secure transfers to Barclays Bank accounts. By carefully verifying all transaction details and selecting appropriate transfer methods, users can minimize risks associated with international money transfers. Understanding SWIFT codes and transfer procedures empowers individuals and businesses to conduct global financial transactions with confidence.