In today's rapidly evolving global financial landscape, international money transfers have become increasingly common. Whether supporting family members abroad or conducting international business transactions, understanding the transfer process and its key components is crucial. This is particularly true when sending money from Barclays Bank UK PLC to France, where familiarity with SWIFT/BIC codes directly impacts the efficiency and security of your transfer. This article explores the structure of SWIFT/BIC codes, examines Barclays' specific code (BUKBGB22CLS), and explains how to use this information effectively for international transfers.

I. Understanding SWIFT/BIC Codes

1.1 What Are SWIFT/BIC Codes?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) and BIC (Bank Identifier Code) are standardized codes that identify financial institutions globally. Established in 1973, the SWIFT system provides a secure messaging network that facilitates cross-border financial transactions. These 8 to 11-character codes efficiently communicate bank identification information, streamlining international money transfers.

1.2 Structure of SWIFT/BIC Codes

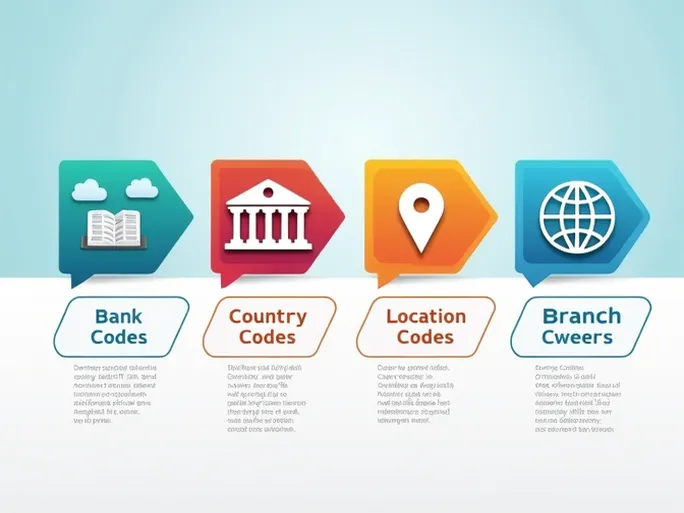

Each SWIFT/BIC code consists of distinct components:

- Bank code (4 characters): Alphabetic representation of the financial institution (e.g., "BUKB" for Barclays Bank UK PLC)

- Country code (2 characters): ISO 3166-1 standard country identifier ("GB" for United Kingdom)

- Location code (2 characters): Alphanumeric code identifying the bank's specific location ("22" in the Barclays example)

- Branch code (3 optional characters): Identifies specific branches ("CLS" in this case; "XXX" denotes the head office)

Breaking down Barclays' code BUKBGB22CLS:

- BUKB: Bank identifier for Barclays Bank UK PLC

- GB: Country code for United Kingdom

- 22: Location code

- CLS: Branch identifier

1.3 Importance of SWIFT/BIC Codes

These codes serve as critical routing information for international transfers, enabling receiving banks to identify the sending institution accurately. Incorrect or missing SWIFT/BIC codes may result in delayed, misdirected, or failed transactions.

II. Transfer Process from Barclays UK to France

2.1 Required Information

Before initiating an international transfer, gather these essential details:

- Recipient's full name (must match bank records)

- Recipient bank's correct SWIFT/BIC code

- Recipient's account number/IBAN

- Transfer amount and currency

- Purpose of payment (for regulatory compliance)

2.2 Step-by-Step Transfer Guide

- Access your Barclays online banking account

- Navigate to the international transfers section

- Enter recipient details including SWIFT/BIC code and account information

- Specify the transfer amount and currency

- Review all information carefully

- Submit the transfer request

2.3 Fees and Processing Times

Barclays typically processes transfers to France within 24 hours, though processing times may vary depending on intermediary banks. Fees depend on the transfer amount and currency exchange rates, with some transactions potentially qualifying for fee waivers.

III. Key Considerations for International Transfers

3.1 Accuracy Is Paramount

Even minor errors in SWIFT/BIC codes or account details can cause significant delays or failed transfers. Always double-check all information before submission.

3.2 Security Measures

To ensure secure transactions:

- Use only official Barclays banking channels

- Avoid conducting transactions on public networks

- Enable two-factor authentication for account security

3.3 Regulatory Compliance

International transfers must comply with both UK and French financial regulations. Be prepared to provide documentation for large transactions or commercial payments.

IV. Advantages of the SWIFT/BIC System

The standardized SWIFT/BIC system offers several benefits for international banking:

- Streamlined processing of cross-border payments

- Reduced errors through automated routing

- Enhanced transparency in fund tracking

V. Conclusion

In our interconnected financial world, understanding SWIFT/BIC codes is essential for successful international money transfers. By familiarizing yourself with Barclays Bank UK PLC's specific code (BUKBGB22CLS) and following proper transfer procedures, you can ensure efficient, secure transactions to France. Whether for personal or business purposes, attention to detail in international banking operations helps guarantee that funds reach their intended destination promptly and securely.