In modern financial transactions, international wire transfers have become a critical tool for businesses and individuals to move funds across borders. Whether conducting global trade, paying overseas partners, or sending money to family abroad, understanding SWIFT codes—unique identifiers assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT)—is essential. These alphanumeric codes ensure funds reach the correct financial institution securely and efficiently.

The Role of SWIFT in Global Finance

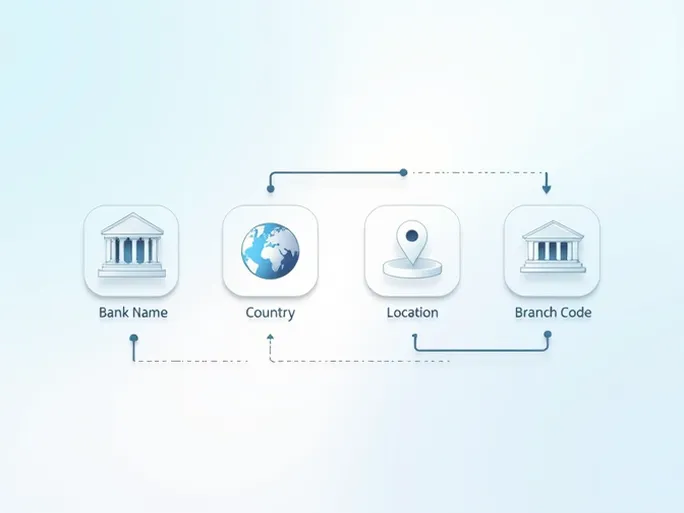

Since its establishment in 1973, the SWIFT network has grown into the backbone of international financial transactions, connecting over 11,000 institutions worldwide. Each SWIFT code consists of 8 to 11 characters: the first four identify the bank, the next two denote the country, followed by a location code, and an optional three-digit branch identifier.

Nordea Bank Abp: A Key Player in Nordic Banking

Headquartered in Helsinki, Nordea Bank Abp was founded in 2000 and has since become one of the largest financial services providers in the Nordic region, with operations in Finland, Sweden, Norway, and Denmark. For customers conducting international transfers to or from Finland, Nordea’s SWIFT codes are indispensable.

Key SWIFT Codes for Nordea Bank Abp in Finland

Below are notable SWIFT codes for Nordea’s branches in Helsinki, Finland’s financial hub:

- NDEAFIHH030 : Main Helsinki branch

- NDEAFIHHHAM : Located at Satamaradankatu 5, Helsinki, FI-00020

- NDEAFIHHIPL : Helsinki branch

- NDEAFIHHISA : Helsinki branch

- NDEAFIHHNCL : Helsinki branch

- NDEAFIHHNFC : Helsinki branch

- NDEAFIHHNFF : Located at Aleksanterinkatu 36, Helsinki, FI-00100

- NDEAFIHHNFH : Helsinki branch

If a specific branch’s SWIFT code is unavailable, Nordea’s global headquarters code can be used, though this may slightly delay processing. Verifying the correct code is crucial to avoid misdirected funds.

Additional Considerations for International Transfers

Beyond SWIFT codes, factors like processing times and fees vary by institution. Transfers typically take hours to days, depending on the banks involved, and costs fluctuate based on currency, amount, and intermediary banks. Digital banking platforms also use SWIFT codes, streamlining cross-border transactions.

While SWIFT ensures security, risks remain. Incorrect codes may divert funds, and fraudulent platforms pose threats. Always use official channels to confirm details.

Conclusion

For seamless international transfers to Finland’s Nordea Bank Abp, accurate SWIFT codes are vital. Coupled with awareness of fees, timelines, and security measures, this knowledge ensures efficient and secure global transactions for individuals and businesses alike.