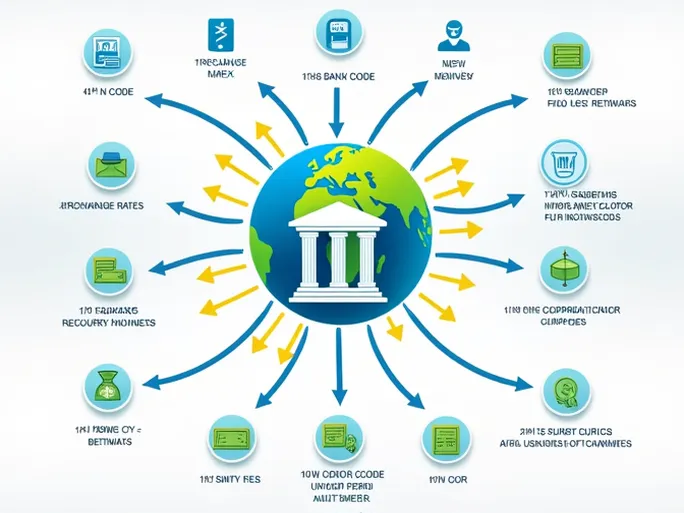

In today's globalized economy, international bank transfers have become a vital tool for individuals and businesses conducting cross-border transactions. As trade and investment continue to expand across national boundaries, the ability to execute international wire transfers efficiently and securely has emerged as a critical concern for users worldwide. At the heart of this process lies the SWIFT code—a unique identifier that serves as both a bank's fingerprint and a safeguard for financial transactions.

Understanding SWIFT Codes

SWIFT (Society for Worldwide Interbank Financial Telecommunication) operates as the backbone of global financial communications, providing secure electronic messaging services to banks and financial institutions worldwide. Take, for example, NORDEA BANK ABP, where international transfers require the specific SWIFT code NDEAFIHHNFC . This alphanumeric sequence follows a precise structure that enables accurate routing of funds.

A typical SWIFT code comprises 8 to 11 characters, each segment carrying specific information. The first four characters (NDEA) represent the bank code, identifying the financial institution. The subsequent two letters (FI) denote the country code (Finland, in this case), followed by two characters (HH) indicating the location code—typically corresponding to the bank's headquarters or primary operational city. The final three characters (NFC) serve as an optional branch identifier, allowing for precise routing to specific offices.

Ensuring Transaction Accuracy

This meticulous classification system significantly reduces the risk of errors in fund transfers, ensuring that payments reach their intended destinations promptly. However, financial institutions occasionally update their SWIFT codes due to mergers, acquisitions, or operational changes. Users should always verify the current SWIFT code through official bank channels before initiating any international transaction.

Beyond the SWIFT code, several other factors demand attention during cross-border transfers. Exchange rates, for instance, fluctuate constantly in response to market conditions. A transfer executed during favorable rate conditions can result in substantial savings, particularly for large transactions. Savvy users monitor exchange rate trends and compare offerings across multiple financial institutions to optimize their transfers.

Navigating Fees and Regulations

Transaction fees represent another critical consideration. Banks employ varying fee structures—some charge flat rates while others calculate fees as a percentage of the transfer amount. These differences can significantly impact the total cost, especially for substantial transfers. A thorough comparison of fee schedules can lead to meaningful savings.

Compliance with international financial regulations remains equally crucial. Countries maintain distinct rules governing foreign currency transactions, with some imposing restrictions on outbound transfers or requiring additional documentation for large payments. Understanding these requirements in advance prevents delays and ensures full compliance with relevant laws.

For both individual users and corporate financial managers, mastering these elements—from SWIFT codes to exchange rates and regulatory compliance—creates a foundation for seamless international banking. In our interconnected financial landscape, such knowledge transforms cross-border transactions from potential challenges into routine operations, empowering users to navigate global markets with confidence.