In today’s globalized financial landscape, international money transfers have become a routine necessity. Whether for paying overseas bills, purchasing foreign goods, or supporting family abroad, the speed and convenience of cross-border transactions are hallmarks of modern financial technology. Central to this process is the use of SWIFT codes. This article explores the SWIFT/BIC code for NORDEA BANK ABP— NDEAFIHHNFF —providing practical guidance to ensure secure and efficient international transfers.

What Is a SWIFT Code?

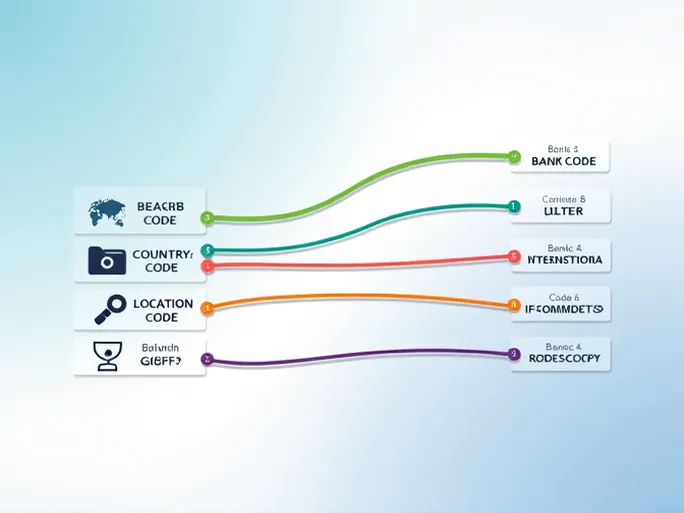

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric identifier assigned to financial institutions by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). This standardized system ensures accuracy and minimizes confusion in global transactions. A typical SWIFT code comprises 8 to 11 characters, structured as follows:

- Bank code (first 4 characters): Identifies the specific institution.

- Country code (next 2 characters): The ISO 3166-1 alpha-2 code of the bank’s registered country.

- Location code (next 2 characters): Specifies the bank’s city or branch.

- Branch code (optional last 3 characters): Denotes a specific department or division.

Breaking down NDEAFIHHNFF :

- NDEA represents NORDEA BANK.

- FI stands for Finland, the bank’s home country.

- HH indicates Helsinki as the location.

- NFF may refer to a specific branch or internal designation.

Why Are SWIFT Codes Critical?

In international transfers, SWIFT codes serve as both an accuracy checkpoint and a security measure. Errors can lead to:

- Misrouted funds: Incorrect codes may direct payments to unintended accounts, risking permanent loss.

- Delays: Rectifying errors often requires time-consuming reversals.

- Additional fees: Failed transactions may incur extra charges.

Always verify the SWIFT code before initiating a transfer to avoid complications.

How to Obtain the Correct SWIFT Code

While many banks list SWIFT codes online, cross-verification is essential. Recommended methods include:

- Contact the recipient: Confirm the code directly with the beneficiary.

- Check official sources: Visit NORDEA BANK ABP’s website for verified details.

- Use banking apps: Some institutions integrate SWIFT code lookup tools.

Step-by-Step Transfer Guide

To ensure a smooth transaction:

- Verify recipient details: Double-check the account number, bank name, and SWIFT code.

- Select a transfer method: Choose between wire transfers, online platforms, or in-person services.

- Complete required forms: Provide accurate information, including currency and amount.

- Review fees and timelines: Confirm processing times and associated costs.

- Finalize and document: Save transaction receipts for reference.

Common Questions About International Transfers

- How long do transfers take? Typically 1–5 business days; expedited options may reduce this.

- Can I cancel a transfer? Only if it hasn’t been processed; contact your bank immediately.

- What if I used the wrong SWIFT code? Notify your bank promptly—recovery depends on the transfer stage.

Understanding SWIFT codes and transfer protocols is indispensable in an increasingly interconnected economy. By prioritizing accuracy and due diligence, individuals can optimize their cross-border financial activities with confidence.