In today's globalized economy, international money transfers have become an indispensable part of cross-border transactions for both individuals and businesses. Whether paying for goods and services or sending money to family and friends abroad, using the correct SWIFT/BIC code is crucial for ensuring secure and efficient fund transfers.

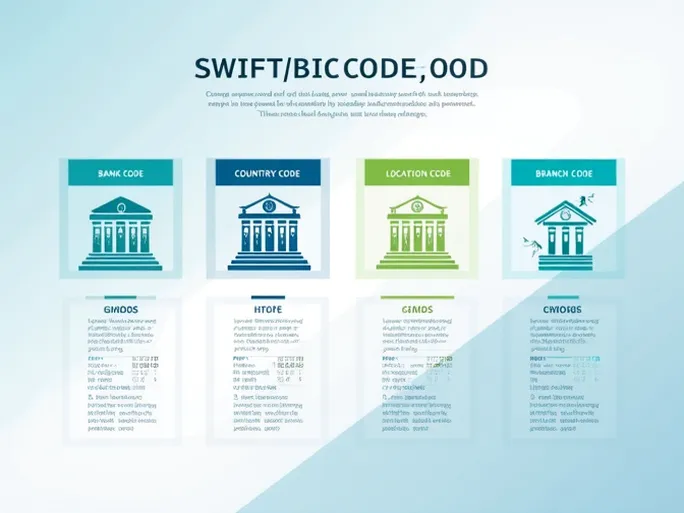

Understanding SWIFT/BIC Code Structure

SWIFT/BIC codes, assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), serve as unique identifiers for banks and financial institutions in international transactions. These codes typically consist of 8 to 11 characters that precisely identify the recipient bank and its location.

The standard format breaks down as follows:

- Bank Code (4 characters) : Identifies the specific financial institution (e.g., FSEB for FIRST SECURITY ISLAMI BANK PLC.)

- Country Code (2 characters) : Follows ISO country standards (e.g., BD for Bangladesh)

- Location Code (2 characters) : Indicates the bank's headquarters location

- Branch Code (3 characters, optional) : Specifies particular branches (XXX denotes the head office)

For example, the code FSEBBDDHAGR for FIRST SECURITY ISLAMI BANK PLC. reveals:

- FSEB: Bank identification

- BD: Country (Bangladesh)

- DH: Location (Dhaka)

- AGR: Specific branch

The Critical Role of SWIFT/BIC Codes

Accurate SWIFT/BIC information is paramount for successful international transfers. Errors can lead to delayed payments, failed transactions, or even lost funds. Proper use of these codes ensures:

- Transaction Accuracy : Precise identification of financial institutions minimizes transfer errors

- Enhanced Security : Works with encryption technologies to prevent data tampering

- Efficient Processing : Enables nearly real-time fund movement through the SWIFT network

- Cost Control : Avoids additional fees from incorrect transfers or reprocessing

Verifying SWIFT/BIC Codes

Before initiating any transfer, verification of the SWIFT/BIC code is essential. Recommended methods include:

- Direct confirmation with the recipient's bank

- Checking the official bank website

- Using specialized verification tools

- Consulting with financial professionals

User Experiences with International Transfers

Many individuals have successfully navigated international money transfers by paying careful attention to SWIFT/BIC details:

"The service proved extremely efficient and user-friendly. I consistently receive excellent support whenever I have questions about transfer processes or code verification."

"I achieved significantly better exchange rates compared to traditional banks, with complete transparency about fees and transfer status throughout the process."

"The professional assistance I received made my first international transfer experience smooth and worry-free, especially when confirming the correct banking codes."

Conclusion

SWIFT/BIC codes form the backbone of secure and efficient international money transfers. By understanding their structure, verifying their accuracy, and selecting reliable transfer services, individuals and businesses can confidently move funds across borders. Proper attention to these banking identifiers ensures transactions reach their intended destinations promptly and securely, facilitating global financial connectivity.