When making international wire transfers, have you ever struggled to locate the correct banking information? SWIFT/BIC codes serve as critical connectors between financial institutions worldwide, where accuracy directly impacts both the security and timely delivery of funds. For both individual and corporate users, understanding these codes is essential for seamless cross-border transactions.

Decoding SWIFT/BIC Structure

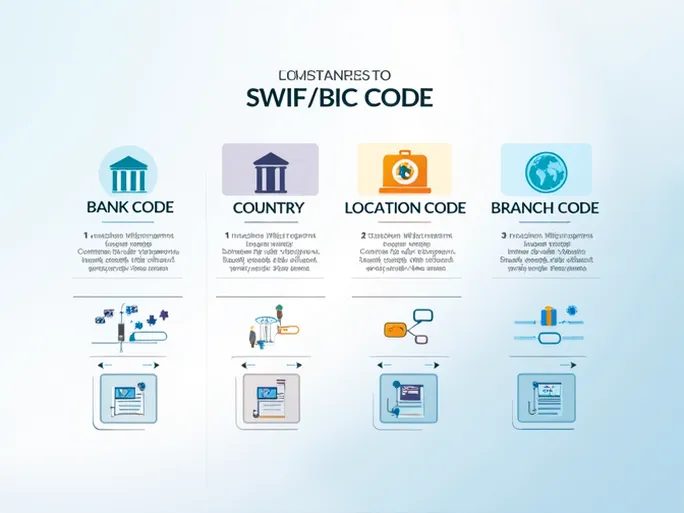

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) code, also known as BIC (Bank Identifier Code), consists of 8 to 11 characters with specific components:

- Bank Code (FSEB): The first four characters identify the specific bank—in this case, FIRST SECURITY ISLAMI BANK PLC.

- Country Code (BD): The following two letters represent the bank's registered country ("BD" for Bangladesh).

- Location Code (DH): The next two characters indicate the bank's primary office location ("DH" for Dhaka).

- Branch Code (DIL): The final three characters specify a particular branch ("DIL"). A terminal "XXX" denotes the bank's headquarters.

Thus, the complete SWIFT/BIC code for FIRST SECURITY ISLAMI BANK PLC. appears as: FSEBBDDHDIL . The truncated 8-character version ( FSEBBDDH ) identifies the bank without branch specificity.

Address and Branch Details

The branch corresponding to this code operates in Dhaka, with its physical address at 23 Dilkusha.

Critical Verification Steps

To prevent transfer delays or errors, users must:

- Verify bank information: Cross-check the recipient's bank name against the SWIFT code.

- Confirm branch details: When using branch-specific codes, ensure alignment with the recipient's provided branch.

- Validate country codes: Given banking networks' global reach, matching the SWIFT code's country identifier prevents misdirected transfers.

Optimizing International Transfers

Modern financial services offer distinct advantages for international transactions:

- Competitive exchange rates: Specialized providers often deliver superior currency conversion rates compared to traditional banks.

- Fee transparency: Clear disclosure of all charges enables informed financial decisions.

- Expedited processing: Many transactions settle within the same business day, addressing time-sensitive needs.

In today's interconnected financial landscape, precise SWIFT/BIC code usage forms the foundation of secure and efficient cross-border payments. Proper implementation ensures funds reach their intended destination without unnecessary complications.