In an increasingly globalized world, cross-border remittances have become a vital part of daily life for individuals and businesses alike. Whether it's an overseas student sending money home or international corporations conducting transactions, financial exchanges across borders are growing. To ensure the accuracy and security of these transfers, SWIFT/BIC codes serve as an international standard. One such example is Eastern Bank Limited (EBL) in Bangladesh, which uses the SWIFT code EBLDBDDH001 . Below, we explore the components of this code and how it facilitates secure international transactions.

The Basics of SWIFT Codes

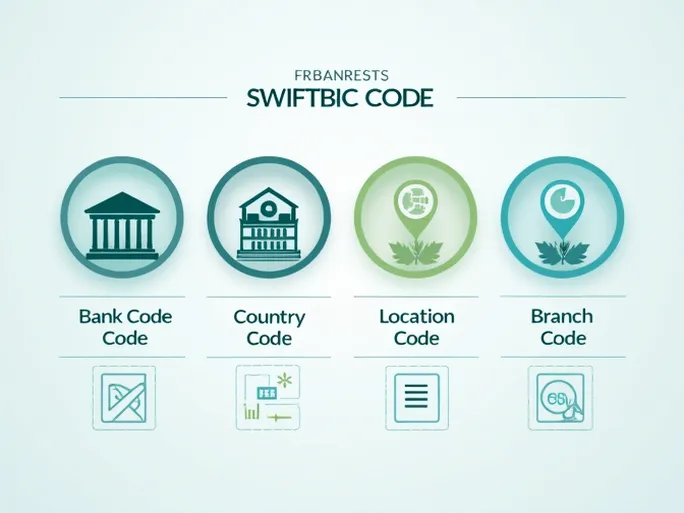

Before delving into EBL's SWIFT code, it's essential to understand the structure and purpose of SWIFT codes. SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global network that enables banks and financial institutions to exchange information and transfer funds efficiently and securely. A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique identifier assigned to each financial institution. Typically, a SWIFT code consists of 8 to 11 characters, structured as follows:

- Bank Code (4 letters): Identifies the bank or financial institution.

- Country Code (2 letters): Indicates the country where the bank is located, using ISO country codes.

- Location Code (2 letters): Specifies the city or region of the bank's headquarters.

- Branch Code (3 letters or digits, optional): Identifies a specific branch. If omitted, "XXX" typically denotes the primary office.

This standardized format ensures seamless communication and fund transfers between financial institutions worldwide.

Decoding Eastern Bank Limited's SWIFT Code

Eastern Bank Limited, a prominent financial institution in Bangladesh, uses the SWIFT code EBLDBDDH001 . Breaking this down:

- Bank Code (EBLD): Represents Eastern Bank Limited.

- Country Code (BD): Stands for Bangladesh, as per ISO standards.

- Location Code (DH): Refers to Dhaka, the capital city where EBL's headquarters is located.

- Branch Code (001): Indicates the bank's main branch. This ensures funds are routed to the primary operational center.

The Role of SWIFT Codes in Cross-Border Transfers

When initiating an international wire transfer, the SWIFT code is critical for ensuring funds reach the correct destination. Transactions often pass through intermediary banks, and the SWIFT network acts as the backbone of this process. For example, to send money to EBL, the sender must provide:

- Sender's details (name, address, account number).

- Recipient's details (name, address, account number).

- Recipient bank's SWIFT code (EBLDBDDH001).

- Transfer amount and currency.

Accuracy is paramount—errors in the SWIFT code can lead to delays, misdirected funds, or even loss of money. Always verify the code before initiating a transfer.

Key Considerations for International Transfers

Beyond ensuring the correct SWIFT code, here are additional factors to keep in mind:

- Transaction Fees: Fees vary by bank and service provider. Compare costs before proceeding.

- Exchange Rates: Currency conversion rates can impact the final amount received. Monitor fluctuations to optimize transfers.

- Processing Time: Transfers may take several days, depending on intermediary banks and regulations.

- Regulatory Compliance: Different countries have varying rules on fund transfers. Be aware of any restrictions.

- Communication: If issues arise, contact your bank or the recipient's bank promptly for resolution.

Conclusion

SWIFT codes like EBLDBDDH001 play an indispensable role in international banking, ensuring secure and efficient cross-border transactions. As financial technology evolves, traditional banks and fintech firms are driving innovation in this space. For individuals and businesses, understanding these systems is key to navigating the global financial landscape with confidence. By mastering the basics of SWIFT/BIC codes, users can safeguard their transactions and optimize their cross-border financial activities.