In today's globalized economy, international money transfers have become indispensable for individuals and businesses alike. Whether supporting family members, conducting business transactions, or making investments, ensuring smooth and secure fund transfers is paramount. This is where SWIFT/BIC codes play a critical role, providing an efficient and accurate method to identify financial institutions worldwide.

1. Understanding SWIFT/BIC Codes and Their Significance

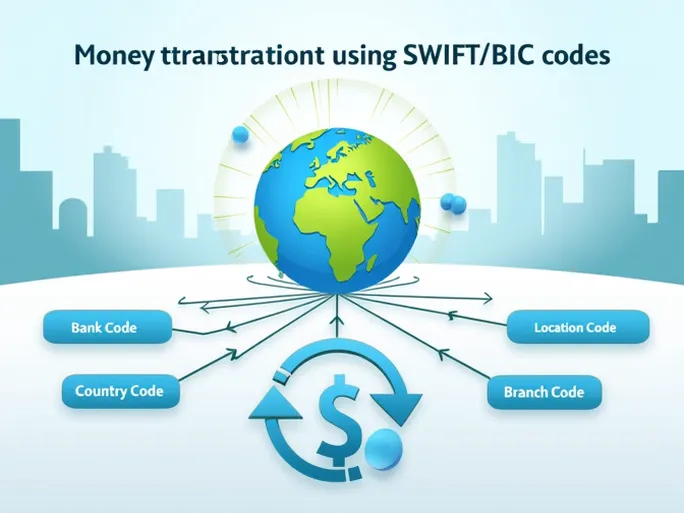

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global member-owned cooperative that facilitates secure financial messaging between banks. The BIC (Bank Identifier Code), a standard under SWIFT, serves as a unique identifier for financial institutions across the globe. Each SWIFT/BIC code consists of 8 to 11 characters, with the initial segment identifying the bank and the latter part specifying a particular branch.

When initiating an international transfer, providing the correct SWIFT/BIC code ensures timely and accurate delivery of funds. Errors in these codes can lead to delays or even loss of funds, making it essential to verify the code before proceeding with any transaction.

2. The Structure of SWIFT/BIC Codes

SWIFT/BIC codes follow a standardized structure:

- Bank code (4 letters): Identifies the specific bank or financial institution (e.g., "BNBO" for Banco Nacional de Bolivia).

- Country code (2 letters): Indicates the bank's country using ISO 3166-1 alpha-2 standards (e.g., "BO" for Bolivia).

- Location code (2 characters): Specifies the bank's location, often a combination of letters and numbers (e.g., "LX").

- Branch code (3 characters, optional): Identifies a specific branch (e.g., "ORU" for a branch in Oruro).

For example, Banco Nacional de Bolivia's SWIFT/BIC code is BNBOBOLXORU, where "BNBOBOLX" represents the bank and its location, and "ORU" denotes the Oruro branch. This structured approach enables seamless cross-border transactions among financial institutions.

3. How to Find and Verify SWIFT/BIC Codes

Before initiating an international transfer, confirming the correct SWIFT/BIC code is crucial. Here are reliable methods to locate and verify these codes:

- Bank websites: Most banks list their SWIFT/BIC codes on their official websites.

- Online SWIFT code tools: Numerous websites offer searchable databases for SWIFT/BIC codes.

- Bank customer service: Contacting the bank directly ensures accurate information.

- Transfer documents: Pre-filled transfer forms often include the necessary banking details.

4. The Role of SWIFT/BIC in International Transfers

SWIFT serves as the backbone of international money transfers, offering:

- Security: Encrypted messaging ensures safe data transmission between banks.

- Standardization: Global transaction standards enable interoperability among financial institutions.

- Transparency: Real-time tracking provides visibility into fund movements.

5. Case Study: Banco Nacional de Bolivia's SWIFT/BIC Code

Examining Banco Nacional de Bolivia's SWIFT/BIC code (BNBOBOLXORU) illustrates how these identifiers function:

- BNBO: Bank identifier

- BO: Country code for Bolivia

- LX: Location code

- ORU: Branch identifier for Oruro

This example demonstrates how SWIFT/BIC codes facilitate precise routing of international payments.

6. Advantages of Digital Money Transfer Services

Modern digital transfer platforms offer significant benefits compared to traditional banks:

- Lower fees and competitive exchange rates

- Faster processing times

- User-friendly interfaces

- 24/7 customer support

7. Key Recommendations

As international money transfers become increasingly common, understanding SWIFT/BIC codes remains essential for successful transactions. Both individuals and businesses should:

- Double-check all banking details before initiating transfers

- Consider digital platforms for cost-effective and efficient transfers

- Stay informed about financial tools that facilitate global transactions

In our interconnected financial world, attention to detail when processing international payments can prevent costly errors and ensure seamless fund transfers across borders.