In an era of globalization, international financial transactions have become an indispensable part of daily life. Whether for personal remittances or corporate trade settlements, individuals and businesses frequently rely on banking and financial institutions. Among these services, SWIFT/BIC codes play a critical role, serving as the first line of defense in ensuring the smooth flow of funds. Today, we will explore the SWIFT code HBTSGBKBXXX of the renowned British bank, Bank of Scotland PLC, uncovering its significance and practical applications.

The Significance of SWIFT/BIC Codes

For those unfamiliar with SWIFT/BIC codes, here’s a brief introduction. A SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is a unique identifier for financial institutions worldwide. Typically composed of 8 to 11 characters, each segment of the code carries specific meaning. SWIFT codes not only guide international transactions but also enhance security and efficiency. For individuals or businesses engaged in cross-border financial activities, understanding SWIFT codes is essential.

Decoding Bank of Scotland PLC’s SWIFT Code: HBTSGBKBXXX

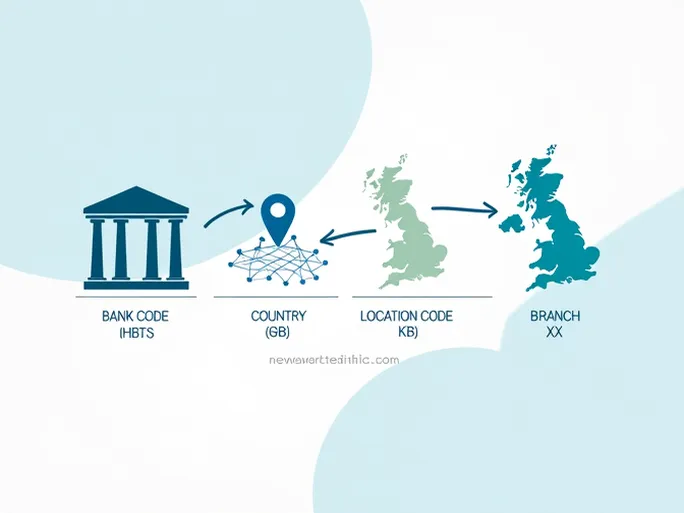

The SWIFT code HBTSGBKBXXX for Bank of Scotland PLC consists of four distinct parts, each conveying vital information.

1. Bank Code (HBTS)

The first four characters, "HBTS," represent the bank’s abbreviated name. Established in 1695, Bank of Scotland is one of the UK’s oldest banks, known for its financial stability and innovative services. It offers a wide range of products, including personal banking, commercial services, and mortgages. Whether applying for a personal loan or managing large-scale investments, Bank of Scotland provides comprehensive support.

2. Country Code (GB)

The next two characters, "GB," stand for Great Britain, indicating the bank’s location in the United Kingdom. Recognizing a bank’s country code is crucial for international transfers, ensuring accuracy and compliance with financial regulations.

3. Location Code (KB)

The following two characters, "KB," specify the bank’s primary operational location. This detail helps senders direct funds to the correct branch, minimizing errors in cross-border transactions.

4. Branch Code (XXX)

The final three characters, "XXX," typically denote the bank’s headquarters. This identifier streamlines transaction processing, improving efficiency. Inaccurate branch codes can delay transfers or even result in financial losses.

The Connection Between SWIFT Codes and Physical Addresses

Bank of Scotland PLC’s registered address is 33 Old Broad Street, London, Greater London, EC2N 1HZ, United Kingdom. When initiating international transfers, verifying that the address matches the provided SWIFT code is fundamental to securing the transaction. Discrepancies between the two may lead to delays or complications, affecting both the sender and recipient.

When to Use the SWIFT Code HBTSGBKBXXX

The SWIFT code HBTSGBKBXXX is indispensable in several scenarios:

1. International Transfers: When sending funds to Bank of Scotland from abroad, the SWIFT code ensures timely and accurate delivery.

2. Fixed Deposits or Investments: For foreign currency investments or deposits, the SWIFT code guarantees that funds reach the intended account.

3. Fee Payments: Whether settling international service charges or commercial invoices, the SWIFT code facilitates seamless transactions.

Using an incorrect SWIFT code may prevent funds from reaching Bank of Scotland, potentially incurring additional fees or requiring reprocessing.

Why SWIFT Codes Matter

The importance of SWIFT codes in international finance cannot be overstated. Here’s why:

1. Reducing Errors and Fraud: Standardized SWIFT codes minimize mistakes and enhance security by ensuring transactions occur within a verified banking network.

2. Accelerating Transactions: The SWIFT system connects global financial institutions, streamlining cross-border payments and reducing processing times.

3. Enhancing Transparency: SWIFT codes allow customers to track transactions in real time, fostering trust and accountability in financial operations.

4. Facilitating Global Commerce: By standardizing international transactions, SWIFT codes bridge legal, cultural, and linguistic gaps, enabling smoother business collaborations.

How to Use SWIFT Codes for International Transfers

Conducting an international transfer is straightforward if you follow these steps:

1. Gather Recipient Details: Ensure you have the recipient’s full name, bank name, SWIFT code (HBTSGBKBXXX), and complete address.

2. Select a Transfer Platform: Choose between traditional banks, online payment services, or currency exchange providers based on your needs.

3. Enter Required Information: Input the transfer amount and recipient details, double-checking the SWIFT code and address for accuracy.

4. Pay Fees: Be aware of any applicable transaction fees, which vary by service provider.

5. Confirm the Transaction: After submission, retain the confirmation receipt for future reference.

6. Track the Transfer: Use the provided transaction ID to monitor the funds’ progress until they reach the recipient’s account.

Conclusion

Understanding and correctly using Bank of Scotland PLC’s SWIFT code, HBTSGBKBXXX, is fundamental to secure and efficient international transactions. As global financial interactions grow, ensuring the accuracy of SWIFT codes and banking details becomes increasingly critical. By mastering the nuances of SWIFT codes, individuals and businesses can navigate cross-border finance with confidence and precision.