Navigating international money transfers can be challenging, with fund security being every customer's primary concern. In this context, the importance of SWIFT/BIC codes becomes undeniable. Take the example of HBTSGBKAXXX, the SWIFT code for Bank of Scotland PLC in London—this alphanumeric sequence serves as the financial equivalent of a global postal address.

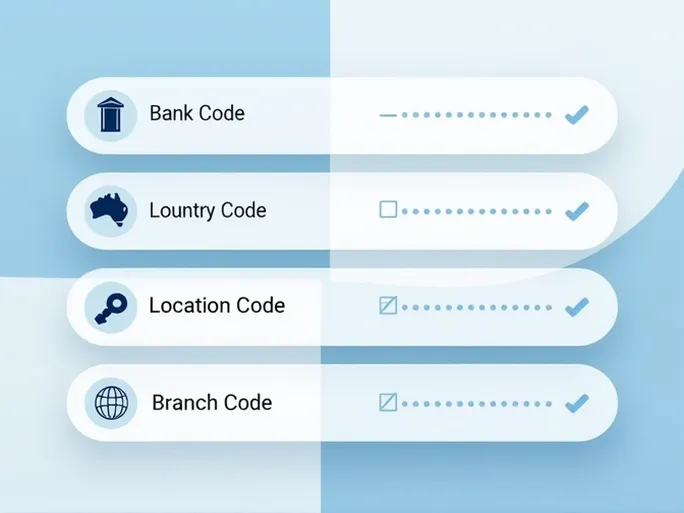

When transferring funds internationally—say, from the United States to France—every detail must be precise. The SWIFT code HBTSGBKAXXX acts as a critical routing identifier that ensures funds reach their intended destination without delays or misdirection. These codes typically consist of 8 to 11 characters that precisely identify the bank, country, location, and sometimes even the specific branch.

The structure of HBTSGBKAXXX reveals its purpose:

- HBTS : The unique bank identifier

- GB : Country code for the United Kingdom

- KA : Location identifier for London

- XXX : Optional branch code (default placeholder when no specific branch is designated)

Bank of Scotland PLC, headquartered at 33 Old Broad Street in London's financial district (EC2N 1HZ), maintains robust infrastructure for efficient international transactions. Selecting established financial institutions like this provides additional security for cross-border transfers.

The SWIFT network has become the global standard for financial messaging, with distinct codes precisely identifying each financial institution across approximately 200 countries. These codes undergo regular updates to maintain compliance with evolving international banking standards. For businesses and individuals conducting frequent international transactions, understanding this system proves invaluable for smooth financial operations.

In international money transfers, selecting the correct SWIFT/BIC code remains paramount. Using HBTSGBKAXXX ensures funds properly route to Bank of Scotland PLC. Financial institutions can provide verification of these codes when needed. Mastering this small but critical detail helps eliminate concerns in cross-border financial transactions.