In today's global financial landscape, cross-border transactions, investments, and fund transfers have become increasingly common. Whether you're an individual investor or a multinational corporation, understanding how to navigate international banking operations is crucial. Among the key tools that ensure secure and efficient money transfers is the SWIFT code.

Understanding SWIFT Codes

The SWIFT code, officially known as the Society for Worldwide Interbank Financial Telecommunication code, is a unique identifier consisting of 8 to 11 characters that distinguishes financial institutions worldwide. When initiating an international transfer, this code serves as the critical link between your bank and the recipient's bank, guaranteeing that funds reach their intended destination accurately.

The Relationship Between Bank Cards and SWIFT Codes

For international transactions, relying solely on a recipient's bank name is insufficient to guarantee accuracy. As global financial systems become more interconnected, security, transparency, and efficiency in fund transfers have become paramount. The SWIFT system was established to address these challenges. By using the correct SWIFT code, you can ensure your funds are transferred quickly and securely to the designated bank.

How to Interpret a SWIFT Code

Each component of a SWIFT code conveys specific information:

- Bank Code (BCEC): The first four letters identify the specific bank. For example, BCEC represents Banco Central de Chile.

- Country Code (CL): The next two letters indicate the bank's country. CL stands for Chile.

- Location Code (RM): The following two letters specify the bank's exact location. RM denotes the bank's headquarters.

- Branch Code (XXX): The final three letters (XXX) indicate transactions with the bank's main office. Specific branch codes would replace these letters for transactions with particular branches.

In this system, the combination BCECCLRMXXX uniquely identifies Banco Central de Chile's headquarters, ensuring precise routing of international transfers.

Why Choose Banco Central de Chile?

As Chile's central bank, Banco Central de Chile plays a vital role in managing the nation's monetary policy. Beyond issuing currency and regulating money supply, it oversees foreign exchange management and promotes financial system stability. When engaging with Chile's financial markets, Banco Central de Chile offers unparalleled reliability.

Whether conducting commodity trades, international investments, or funding business operations in Chile, using the correct SWIFT code is essential for efficient and timely transactions.

The Importance of SWIFT Codes in International Transfers

The complexity of international transfers stems from involving multiple countries and financial systems, where consistency and accuracy are crucial. SWIFT codes provide a standardized method to identify financial institutions globally.

- Security: SWIFT codes connect to a dedicated banking network with high-level encryption and verification protocols, minimizing risks of unauthorized access or data breaches.

- Speed: Compared to traditional transfer methods, SWIFT-enabled transactions are processed within hours or days, facilitating smoother cash flow for businesses.

- Transparency: The SWIFT system allows all parties to track transaction progress in real time, enhancing oversight and efficiency.

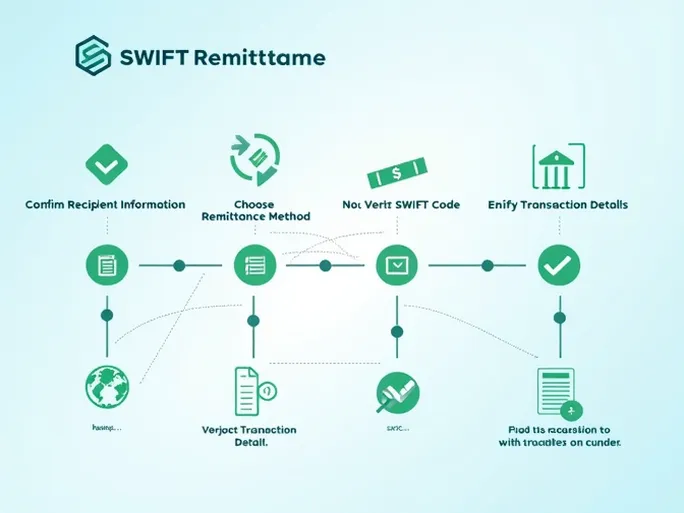

How to Use SWIFT Codes for International Transfers

When initiating an international transfer, follow these steps:

- Verify recipient details: Confirm the recipient's bank name, SWIFT code, and account information before proceeding.

- Select a transfer method: Choose between wire transfers, online banking, or other available options based on your needs.

- Enter the SWIFT code: Input the recipient's SWIFT code carefully during the transfer process. An incorrect code may result in misdirected funds.

- Review transaction details: Double-check all entered information, including amount, date, and bank details, before submission.

- Retain transaction records: Save receipts and confirmation documents for future reference and tracking.

Key Considerations for International Transfers

When conducting cross-border transactions, keep these factors in mind:

- Transaction fees: International transfers often incur higher fees, which vary by bank, amount, and destination. Research these costs beforehand to manage your budget effectively.

- Exchange rate fluctuations: Currency value changes can impact the final transferred amount. Monitoring exchange rate trends is advisable for optimal timing.

- Updated information: SWIFT codes may change without notice. Always verify the current code through official bank sources before initiating transfers.

Conclusion

As international financial transactions continue to grow in volume and complexity, SWIFT codes remain indispensable for secure and efficient cross-border banking. Mastering their use ensures smoother global operations for both individuals and businesses. Banco Central de Chile and its SWIFT code BCECCLRMXXX stand as reliable partners in international finance, facilitating seamless transactions in Chile's dynamic economy.

From verifying SWIFT codes to ensuring transaction security, attention to detail is paramount. In an interconnected financial world, these protocols help navigate global markets with confidence and precision.