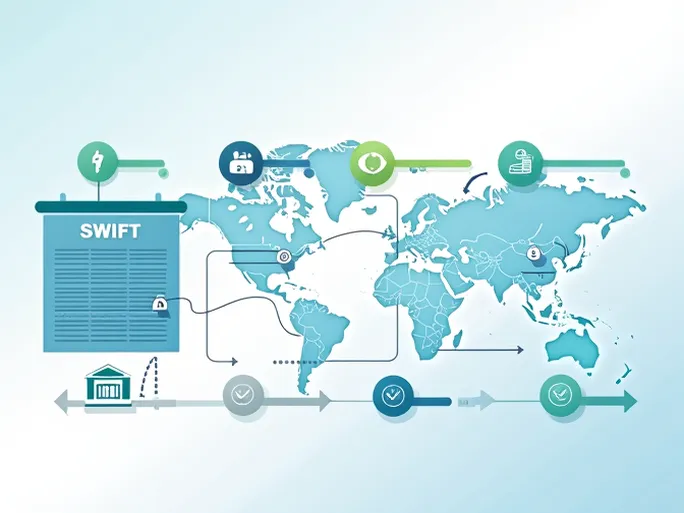

In today's globalized economy, international money transfers have become an indispensable part of daily life for both individuals and businesses. As cross-border transactions and migration continue to increase, the importance of conducting international transfers correctly, securely, and efficiently grows ever more critical. At the heart of secure and seamless transactions lies the proper use of SWIFT codes—a fundamental component that users must understand thoroughly.

Understanding SWIFT Codes in Global Banking

International money transfers encompass various financial services where the transacting parties may reside in different countries and use different currencies. This complexity makes the identification of recipient banks and the accurate routing of funds particularly challenging. SWIFT codes serve as global bank identifiers that help overcome this challenge.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is not merely a code but an extensive global banking network that enables financial institutions worldwide to conduct secure and efficient transactions. For example, BANK OF SCOTLAND PLC, a prominent UK-based financial institution with a long history and extensive experience, uses the SWIFT code BOFSGB2SXXX. This code follows a standardized structure:

- Bank code (4 letters): BOFS identifies BANK OF SCOTLAND PLC

- Country code (2 letters): GB represents the United Kingdom

- Location code (2 alphanumeric characters): 2S specifies the bank's particular location in the UK

- Branch code (optional 3 letters): XXX typically denotes the bank's head office or a specific branch

Understanding this structure helps senders correctly identify the required SWIFT code, minimizing errors that could disrupt transactions.

Critical Considerations for Using SWIFT Codes

While SWIFT codes facilitate international transfers, users must exercise caution to ensure smooth transactions. First and foremost, verifying the accuracy of the SWIFT code is paramount. An incorrect code may not only prevent funds from reaching the intended recipient but could potentially redirect them to the wrong account. Users should cross-check the provided SWIFT code with official bank sources before initiating any transfer.

Beyond the SWIFT code, senders must ensure the accuracy of other essential details, including the recipient's account number, full name, and address. Additionally, understanding transfer fees, exchange rates, and processing times helps users make informed decisions. Since these factors vary across banks, comparing options can optimize cost-efficiency while maintaining security.

Regulatory differences between countries also warrant attention. Some jurisdictions impose specific restrictions or require additional documentation for international transfers, particularly for large transactions or transfers involving certain nations. Familiarizing oneself with relevant regulations ensures compliance and reduces potential risks.

Security in the Digital Age

With the rapid advancement of technology, many banks and financial institutions now offer online transfer services, significantly enhancing convenience. However, this digital shift also introduces cybersecurity risks. Users must exercise vigilance when handling personal information online, opting only for reputable platforms and banking services to mitigate fraud risks. Any suspicious messages or transaction requests should prompt immediate contact with the bank or relevant authorities.

Tailoring Transfers to Specific Needs

International transfer requirements vary widely between individuals and businesses. Individuals may need to support family members abroad, pay tuition fees for overseas students, or make purchases while traveling. Businesses, on the other hand, often deal with more complex transactions involving international trade and supply chain payments. Selecting the appropriate transfer method—whether through traditional banking channels or specialized services—depends on the specific context and requirements of each transaction.

Clear communication with all parties involved—banks, recipients, and business partners—plays a crucial role in preventing misunderstandings. In commercial transactions, for instance, confirming payment terms, transfer methods, and associated costs in advance ensures smoother financial operations. Modern communication tools like email and instant messaging can facilitate quick resolution of any issues that may arise.

Planning for Successful Transfers

Proactive planning remains essential for successful international money transfers. Users should account for potential delays caused by factors such as market fluctuations, time zone differences, or local holidays. Whether for personal or business purposes, allocating sufficient time for the transfer process helps avoid last-minute complications.

In summary, a seamless international transfer experience hinges on selecting the right banking partner, using accurate SWIFT codes, and adhering to careful operational practices. Understanding the SWIFT system, following proper procedures, and staying informed about regulations and fees all contribute to successful cross-border financial transactions. In an increasingly interconnected financial landscape, maintaining awareness and choosing secure, reliable channels ensures that each transfer meets its intended purpose efficiently and safely.