In today's rapidly globalizing world, international money transfers have become a common practice for individuals and businesses engaging in cross-border transactions, investments, and personal fund transfers. However, the process of international remittance is often complex, with the use of SWIFT codes being its most critical component. Much like how navigation devices are essential for driving to a destination, SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are indispensable for ensuring the secure and swift transfer of funds internationally. This article focuses on Denmark's National Bank and its SWIFT code details to help streamline your international transactions.

Understanding SWIFT Codes and Their Importance

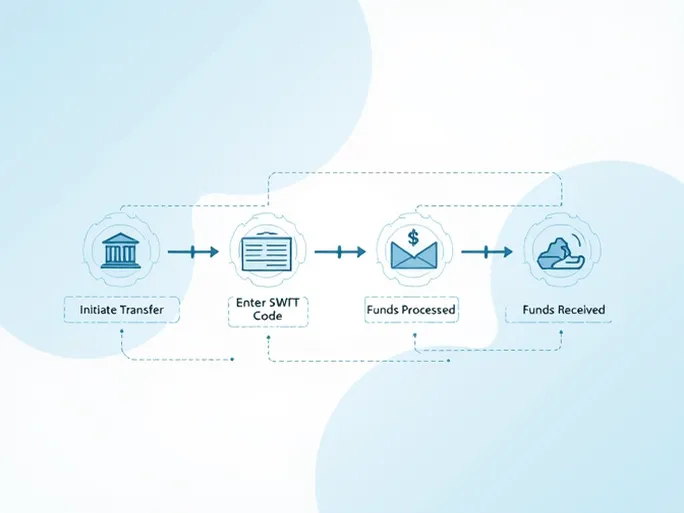

Before delving into Denmark's National Bank SWIFT code, it's essential to understand what SWIFT codes are and their role in the global financial system. Established in 1973, SWIFT provides a fast, secure, and reliable communication network for financial institutions worldwide. In international transfers, a SWIFT code acts as a unique identifier for each bank, similar to a financial passport. This code ensures that funds reach the correct destination efficiently.

A standard SWIFT code consists of 8 to 11 characters with the following structure:

- Bank Code (4 letters): Identifies the specific bank (e.g., DKNB for Denmark's National Bank).

- Country Code (2 letters): Denotes the country (DK for Denmark).

- Location Code (2 letters): Indicates the bank's headquarters city or region (KK for Denmark's National Bank).

- Branch Code (3 characters, optional): Specifies a particular branch. 'XXX' typically represents the bank's head office.

Using the correct SWIFT code is crucial for secure and timely fund transfers. Errors can lead to delays or even financial losses, making it imperative to verify this information before initiating any transaction.

Overview of Denmark's National Bank

Denmark's National Bank (Danmarks Nationalbank, commonly abbreviated as DNB), founded in 1818, serves as the country's central bank. It is responsible for implementing monetary policy, maintaining financial stability, and providing essential banking services. Beyond serving the government, DNB supports other commercial banks and international institutions with financial operations.

Key functions of Denmark's National Bank include:

- Monetary Policy: DNB formulates and executes policies to control inflation and foster sustainable economic growth.

- Financial Stability: The bank oversees commercial banks and financial institutions to ensure their sound operation.

- National Treasury Management: It manages Denmark's foreign exchange reserves and other financial assets to maintain fiscal stability.

- Payment Systems: DNB develops and operates secure financial settlement systems to facilitate efficient market transactions.

Additionally, DNB actively participates in international finance as a member of organizations like the International Monetary Fund and the European Central Bank, enhancing Denmark's role in global economic cooperation.

Denmark's National Bank SWIFT Code: DKNBDKKK

The SWIFT code for Denmark's National Bank is DKNBDKKK . This code is mandatory for all international transfers involving the bank. Providing the correct SWIFT code minimizes errors and ensures smooth processing.

Why the SWIFT Code Matters

When transferring funds internationally, the SWIFT code is the first checkpoint for accuracy. For instance, if you're sending money from another country to a Danish account at DNB, the SWIFT code ensures your bank identifies the correct recipient institution. Omitting or entering an incorrect code may result in processing delays, additional fees, or failed transactions. Many banks worldwide reject transfers without valid SWIFT codes, emphasizing their necessity.

Complete Banking Information for Transfers

Beyond the SWIFT code, you must provide the following details for successful transfers to Denmark's National Bank:

- Bank Address: Langelinie Alle 47, 2100 Copenhagen, Region Hovedstaden, Denmark.

- Recipient Details: Full name, account number, and contact information of the beneficiary.

- Transfer Amount and Currency: Specify the exact sum and currency type to ensure proper conversion and processing.

Conclusion

Using the correct SWIFT code is fundamental to successful international transactions. For Denmark's National Bank, the code DKNBDKKK must be accurately provided to avoid complications. Ensuring precise banking details further guarantees that your funds reach their destination securely and efficiently. Whether for personal or business purposes, understanding these elements will empower you to navigate global financial transactions with confidence.