In today's globalized world, international money transfers have become increasingly common, connecting people and businesses across borders. However, many lack a thorough understanding of critical details in the transfer process, particularly the importance of SWIFT/BIC codes. Ensuring the accuracy of these codes is paramount for successful transactions. Using BANCO BISA S.A. as an example, this article examines the structure of SWIFT/BIC codes and how to verify them for seamless international transfers.

Understanding SWIFT/BIC Codes

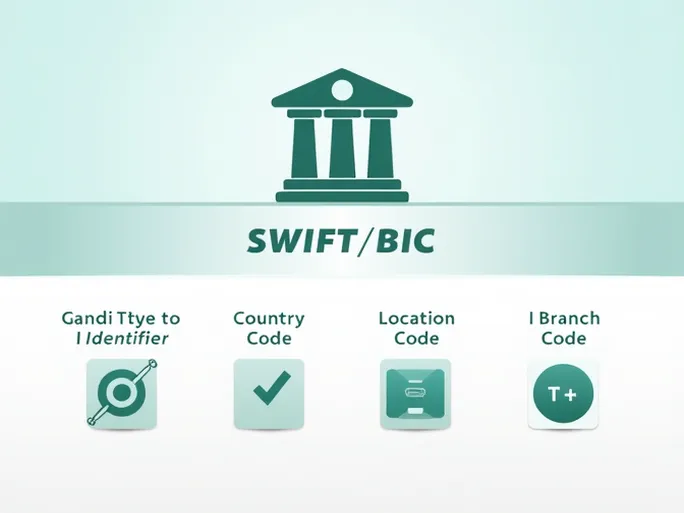

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) provides standardized codes—known as Bank Identifier Codes (BIC)—to facilitate global financial transactions. Each bank has a unique SWIFT/BIC code, serving as its identifier in cross-border payments. These codes typically consist of 8 to 11 characters, each with specific meaning.

Components of a SWIFT/BIC Code

- Bank Code (BANI): Four letters identifying the bank. For BANCO BISA S.A., this is "BANI," derived from "BISA."

- Country Code: Two letters representing the bank's country. BANCO BISA S.A. uses "BO" for Bolivia.

- Location Code: Two characters indicating the bank's geographic location. For BANCO BISA S.A., this is "LX."

- Branch Code: Optional three digits specifying a particular branch. BANCO BISA S.A.'s branch code is "SCZ."

Thus, BANCO BISA S.A.'s complete SWIFT/BIC code is BANIBOLXSCZ . This code is essential for ensuring funds reach the intended recipient securely and promptly.

Verification Tips for International Transfers

When initiating a transfer, consider the following:

- Confirm the bank name: Ensure the recipient's bank name matches the details provided.

- Check the branch code: If using a branch-specific code, verify it corresponds to the recipient's branch.

- Validate country and location codes: Errors in these details may cause delays or failed transactions.

About BANCO BISA S.A.

A leading financial institution in Bolivia, BANCO BISA S.A. offers services ranging from personal and corporate banking to international transfers. Its reputation for efficiency and customer service makes it a preferred choice for cross-border transactions.

Additional Considerations for International Transfers

Beyond SWIFT/BIC codes, other factors influence successful transfers:

- Fees: Compare charges across banks to minimize costs.

- Processing time: Account for delays due to bank procedures or time zones.

- Currency conversion: Be aware of exchange rates and fees if transferring between currencies.

- Accuracy: Double-check recipient details, including account numbers and names.

Leveraging Technology for Smoother Transfers

Advancements in fintech have diversified transfer options, offering alternatives to traditional banks. Factors like speed, security, and ease of use should guide the choice of service.

Conclusion

SWIFT/BIC codes are foundational to international transfers. Understanding their structure and verifying their accuracy enhances transaction efficiency and minimizes risks. Whether for personal or business purposes, mastering these details ensures seamless global connectivity.