In today's globalized economy, cross-border bank transfers have become an essential task for both individuals and businesses. With the rise of international trade and personal migration, the demand for international money transfers has surged. Amidst the multitude of banks and financial institutions, choosing a secure, reliable, and efficient method for remittances is crucial. In this context, BGFIGALIXXX, the SWIFT code for BGFIBANK, has emerged as a preferred choice for many users. This article explores the usage and advantages of this SWIFT code to help facilitate seamless international fund transfers.

Background of BGFIBANK

BGFIBANK, headquartered in Libreville, Gabon, is one of the country's largest commercial banks. Located on Boulevard de l'Indépendance, the bank boasts strong capital reserves and an extensive service network. It offers a diverse range of financial services, including personal banking, corporate banking, investment banking, and wealth management. Catering to both individual and corporate clients, BGFIBANK provides tailored financial solutions to meet varying needs.

As a bank with an international outlook, BGFIBANK participates in the global banking network, ensuring smooth international transactions through its SWIFT code, BGFIGALIXXX. SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging system used by banks, with each institution assigned a unique SWIFT/BIC code for identification.

The Importance and Structure of SWIFT Codes

SWIFT codes play a pivotal role in securing international fund transfers. The BGFIGALIXXX code consists of 8 to 11 characters, structured as follows:

- Bank Code (BGFI): This four-letter identifier represents BGFIBANK, helping receiving banks accurately identify the sender.

- Country Code (GA): The two-letter code denotes Gabon as the bank's home country.

- Location Code (LI): These two letters indicate the bank's headquarters in Libreville.

- Branch Code (XXX): The three-letter suffix signifies the bank's primary office.

This structured identification system enhances both the security and efficiency of transactions. By using SWIFT codes, errors in international transfers are minimized, ensuring funds reach the intended recipient.

Steps for International Transfers Using BGFIGALIXXX

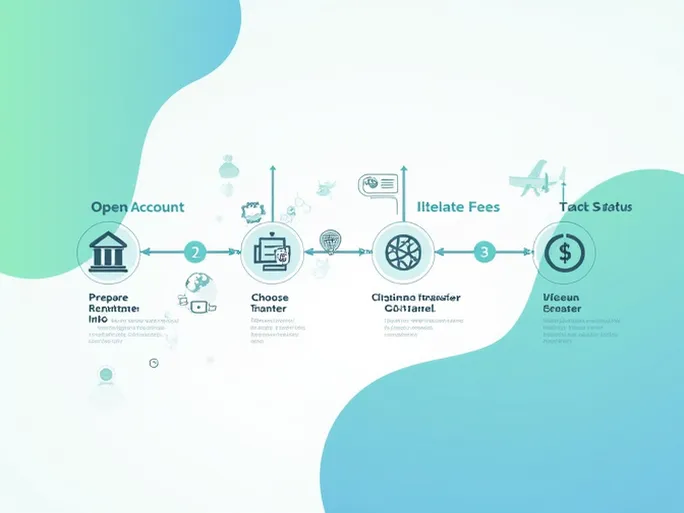

To initiate an international transfer through BGFIBANK, follow these steps:

- Open an Account: If you don’t already have an account with BGFIBANK, visit their official website or a local branch to open one. Required documents typically include identification and proof of address.

- Prepare Transfer Details: Gather the recipient's banking information, including their SWIFT code (BGFIGALIXXX), account name and number, address, and the purpose of the transfer.

- Select a Transfer Method: BGFIBANK offers multiple options, such as online transfers, in-person transactions at branches, or mobile banking apps. Consider factors like fees and processing times when choosing.

- Confirm Fees and Exchange Rates: BGFIBANK provides transparent fee structures. For example, platforms like Xe offer competitive exchange rates with no transfer fees, maximizing the amount sent abroad.

- Initiate the Transfer: Once all details are verified, proceed with the transfer via BGFIBANK's online or mobile banking systems, which may require identity verification for security.

- Track the Transfer: Monitor the transaction status through BGFIBANK's online tracking tools to ensure successful delivery.

Advantages of No Fees and Real-Time Exchange Rates

Cost and exchange rates are critical considerations in international transfers. Using BGFIGALIXXX with platforms like Xe allows for fee-free transactions, ensuring the full transfer amount reaches the recipient. Additionally, real-time exchange rate updates enable users to optimize their transfers for the best possible rates.

While BGFIBANK may not charge transfer fees, intermediary banks could impose charges. It’s advisable to confirm all potential fees beforehand to avoid unexpected deductions.

Security and Privacy Protections

Security is paramount in international banking. BGFIBANK employs advanced encryption technologies, two-factor authentication, and dynamic passwords to safeguard client data. A dedicated risk management team monitors transactions for anomalies, ensuring compliance and security.

Whether for routine remittances or large transactions, BGFIGALIXXX provides a trustworthy channel for cross-border transfers, aligning with the demands of global finance.

Conclusion and Future Outlook

BGFIBANK's SWIFT code, BGFIGALIXXX, offers a reliable and cost-effective solution for international money transfers. As global financial transactions continue to grow, BGFIBANK is well-positioned to meet evolving needs with innovative services.

With advancements in financial technology, international remittances are becoming faster and more accessible. BGFIBANK's commitment to innovation ensures users can expect even greater convenience and efficiency in the future.