In today’s globalized financial landscape, cross-border payments have become increasingly common. But how can you ensure your funds reach their destination safely and accurately? One critical element is the SWIFT code—a bank’s unique identifier that enables efficient and precise international transfers. Using the correct SWIFT code is paramount when initiating cross-border transactions.

For instance, the SWIFT code PASCITMMALA belongs to Italy’s BANCA MONTE DEI PASCHI DI SIENA S.P.A. , specifically identifying its branch in the city of Alba . This alphanumeric sequence ensures funds are routed correctly, minimizing delays or errors.

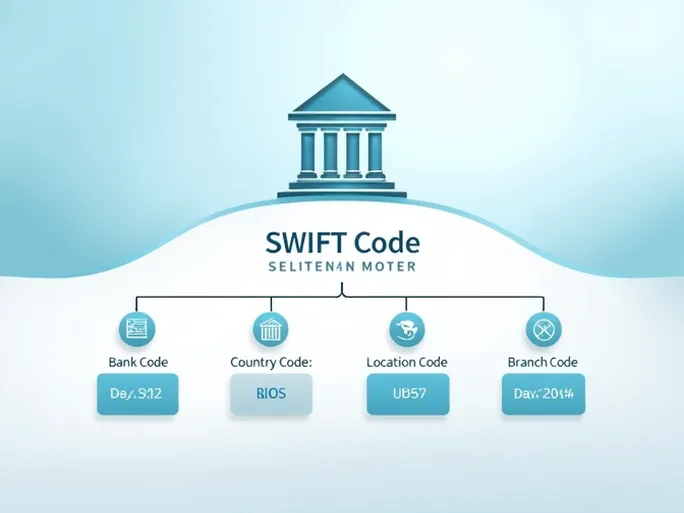

Decoding the SWIFT System

Let’s break down the components of PASCITMMALA :

- Bank Code (PASC) : Represents BANCA MONTE DEI PASCHI DI SIENA S.P.A.

- Country Code (IT) : Indicates Italy as the bank’s location.

- Location Code (MM) : Specifies the operational city or region.

- Branch Code (ALA) : An optional suffix pinpointing the exact branch.

Why SWIFT Codes Matter

SWIFT codes act as a financial GPS, ensuring seamless cross-border transactions. Errors in these codes can lead to misdirected payments or costly delays. Verifying the recipient’s SWIFT code before initiating a transfer is a simple yet effective safeguard against such issues.

These codes are indispensable for:

- International wire transfers

- Trade finance transactions

- Personal remittances abroad

Mastering this system enhances efficiency in global financial operations. Whether you’re a business managing overseas suppliers or an individual supporting family abroad, accurate SWIFT code usage ensures timely delivery of funds.