In today's rapidly globalizing financial landscape, cross-border transfers have become an essential service for both individuals and businesses conducting international transactions, paying for goods and services, or sending money to family and friends. In this context, the importance of SWIFT codes cannot be overstated, particularly for those looking to transfer funds to China Merchants Bank (CMB).

China Merchants Bank SWIFT Code: CMBCCNBS051

The SWIFT code CMBCCNBS051 serves as a critical tool for international money transfers to China Merchants Bank, ensuring timely and secure delivery of funds. Whether for personal remittances or corporate transactions, using the correct SWIFT code significantly reduces transfer risks and guarantees that funds reach the intended recipient without errors.

Before initiating an international transfer, it's crucial to understand the relevant banking information and transfer requirements. China Merchants Bank, one of China's leading commercial banks, has its headquarters in Shanghai with the following complete details:

- Bank Name: China Merchants Bank

- City: Shanghai

- Address: No. 66 Lujiazui Road, Pudong New District, Shanghai, Postal Code: 200120

- Country: China

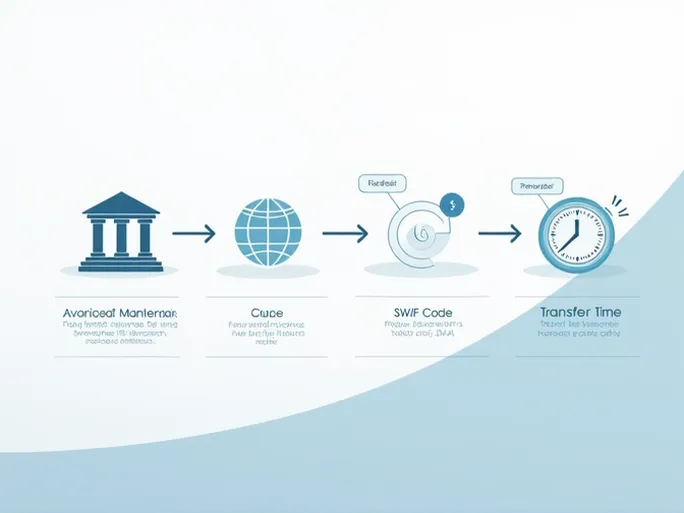

Understanding Currency Conversion and Processing Times

Currency exchange rates represent one of the most variable factors in cross-border transfers. For instance, a transfer of $10,000 USD to China Merchants Bank would convert to approximately €8,491.00 based on current market rates, though the actual received amount may vary slightly due to market fluctuations.

When planning a transfer, it's advisable to check the current exchange rates as banks typically use market benchmarks for currency conversion, which may result in slight variations between institutions. The standard processing time for transfers to China Merchants Bank is approximately three business days, though the bank does offer automated debit services to streamline the process.

Ensuring a Smooth Transfer Process

Accuracy is paramount when initiating international transfers. Even a single incorrect character in the SWIFT/BIC code (CMBCCNBS051) can cause delays or misdirected funds. To maximize transfer success rates, include comprehensive recipient details such as:

- Full recipient name (as it appears on bank records)

- Complete bank account number

- Recipient's physical address

Regulatory Considerations and Additional Fees

International money transfers are subject to various national regulations and policies. China's foreign exchange controls, for example, may require supporting documentation for large transfers, potentially affecting processing times. It's essential to understand these requirements before initiating a transfer.

Transfer fees constitute another important consideration, typically including:

- Sending bank charges

- Receiving bank fees

- Potential intermediary bank costs

Alternative Transfer Options

While traditional bank transfers remain the standard method for international remittances, emerging financial technologies have introduced alternative options through online payment platforms and mobile payment tools. These alternatives often feature lower fees and faster processing times, though users should verify platform credentials and security measures before proceeding.

Whether using conventional banking channels or modern fintech solutions, accurate banking information—particularly the correct SWIFT code—remains fundamental to successful international transfers. For China Merchants Bank, the SWIFT code CMBCCNBS051 serves as this critical identifier, ensuring both the security and efficiency of your cross-border transactions.