When making international wire transfers, ensuring the accuracy of the SWIFT/BIC code is critical. UBS Switzerland AG, a prominent global financial institution, utilizes its unique SWIFT code— UBSWCHZH10A —for cross-border transactions. Headquartered in Lausanne, Switzerland, at Place St-François 16, Vaud, 1002 , the bank relies on this standardized identifier to facilitate secure and timely fund transfers while minimizing operational risks.

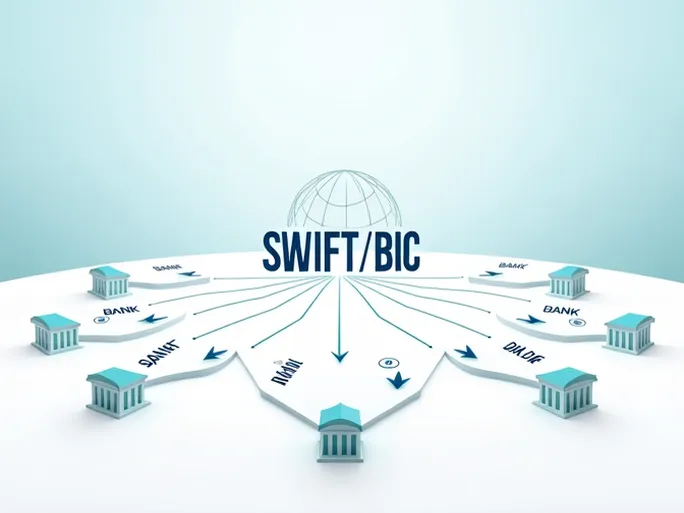

Understanding SWIFT/BIC Codes

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes, also referred to as BIC (Bank Identifier Codes), are alphanumeric identifiers used to distinguish banks and financial institutions in international transactions. These codes are fundamental to the global banking system, ensuring seamless cross-border payments.

The structure of UBSWCHZH10A reveals key details:

- UBS – Represents the bank's name (UBS).

- CH – Denotes Switzerland as the country of origin.

- ZH – Indicates the regional code.

- 10A – May specify a particular branch.

Incorrect SWIFT codes can lead to payment delays or even loss of funds. Therefore, verifying the recipient bank’s name, SWIFT/BIC code, and address is essential before initiating any transfer.

Why Accuracy Matters for UBS Transactions

UBS Switzerland AG, a leading private bank and wealth manager, offers a wide range of financial services, including personal banking, corporate banking, investment banking, and asset management. Its robust global network and strong capital position ensure transaction security and efficiency.

For clients sending or receiving funds via UBS, using the correct SWIFT code UBSWCHZH10A guarantees that payments reach the intended account without complications. Any discrepancies in the provided banking details may result in processing delays or failed transactions.

Best Practices for International Wire Transfers

To mitigate risks when conducting cross-border transactions:

- Double-check the recipient’s bank name, SWIFT/BIC code, and account number.

- Confirm the bank’s physical address if required.

- Consult with your bank or financial advisor if uncertain about any details.

By adhering to these guidelines, individuals and businesses can enhance the reliability of international payments and optimize fund transfer efficiency.