In today's globalized economy, cross-border money transfers have become a routine financial activity. Whether it's overseas workers sending money home or businesses conducting international transactions, the security and efficiency of these transfers are paramount. At the heart of this system lies the SWIFT code - an indispensable component of international banking identification.

Imagine you're sending money to Banco de Sabadell, S.A. in Spain. The key element ensuring your funds reach the correct destination is its SWIFT code: BSABESBBBME. This seemingly random string of letters and numbers is actually a carefully structured identifier that facilitates smooth international transactions.

Understanding SWIFT and BIC Codes

SWIFT (Society for Worldwide Interbank Financial Telecommunication) and its BIC (Bank Identifier Code) are crucial components of global financial transactions. These standardized codes enable banks worldwide to identify each other, creating a unified system for international money movement.

When initiating an international transfer, providing the recipient bank's SWIFT/BIC code ensures your funds are routed accurately. The code BSABESBBBME for Banco de Sabadell serves as an excellent example to understand how these identifiers work.

Decoding the SWIFT/BIC Structure

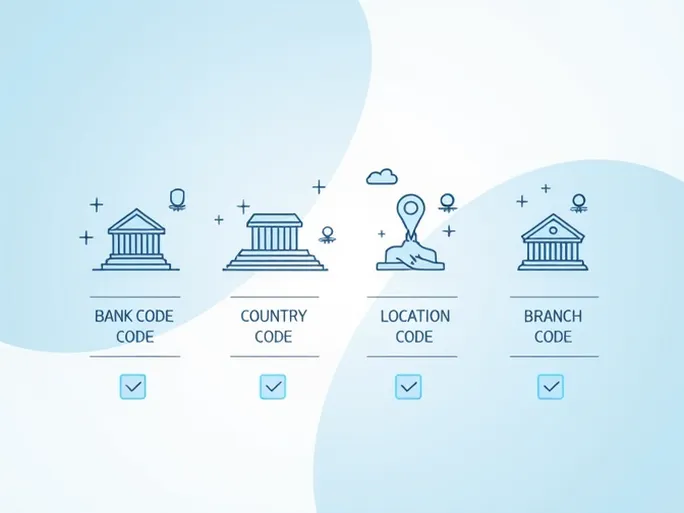

Each segment of a SWIFT code carries specific information about the financial institution:

- Bank Code (First 4 characters - BSAB): Identifies the specific financial institution. In this case, it points to Banco de Sabadell, S.A., a prominent Spanish bank offering various financial services. Accuracy here is critical as errors could misdirect funds to the wrong bank.

- Country Code (Next 2 characters - ES): Indicates the bank's home country (Spain in this example). This helps the transfer system quickly determine the destination country among thousands of global banks.

- Location Code (Next 2 characters - BB): Specifies the bank's headquarters location, narrowing down the search for the correct institution. Some banks may have multiple location codes representing different branches or centers.

- Branch Code (Last 3 characters - BME): Identifies specific branches. When appearing as 'XXX', it indicates the bank's main office, ensuring funds reach the primary institution if no specific branch is designated.

Practical Application for International Transfers

To ensure successful international money transfers using SWIFT codes:

- Verify the accuracy of the SWIFT/BIC code directly with the recipient or through the bank's official website.

- Utilize reliable online SWIFT code lookup tools to confirm banking information, saving time for frequent transfers.

- Initiate transfers during normal banking hours, as many institutions pause international transactions on weekends and holidays.

- Maintain detailed transaction records including amount, date, and the recipient bank's SWIFT code for tracking purposes.

The Global Impact of SWIFT

The SWIFT system has revolutionized international finance by:

- Reducing transfer times from days to hours in many cases

- Enhancing transaction security across borders

- Standardizing global financial communications

- Facilitating smoother international business operations

Far from being just a random combination of characters, SWIFT codes represent the sophistication of modern financial technology. Understanding their structure and proper use ensures that international money transfers can be conducted with confidence, security, and efficiency.

As global financial interactions continue to grow, familiarity with SWIFT codes provides individuals and businesses with essential tools for navigating the complexities of cross-border transactions. Whether for personal remittances or commercial payments, this knowledge contributes to smoother financial operations in our interconnected world.