In today’s globalized economy, international money transfers have become a common financial activity, whether for business transactions or personal remittances. One critical element in this process is the SWIFT code, also known as the Bank Identifier Code (BIC). This standardized code, typically consisting of 8 to 11 characters, uniquely identifies financial institutions worldwide. For those planning to send funds to Belarus’ Priorbank, knowing its SWIFT/BIC code is essential.

An Overview of Priorbank

Founded in 1991 and headquartered in Minsk, Priorbank is one of Belarus’ leading financial institutions. It offers a comprehensive range of services, including retail and corporate banking, investment solutions, and international payment processing. For businesses and individuals engaged in cross-border transactions, Priorbank provides competitive liquidity and cost-effective transfer options, making it a key player in global financial markets.

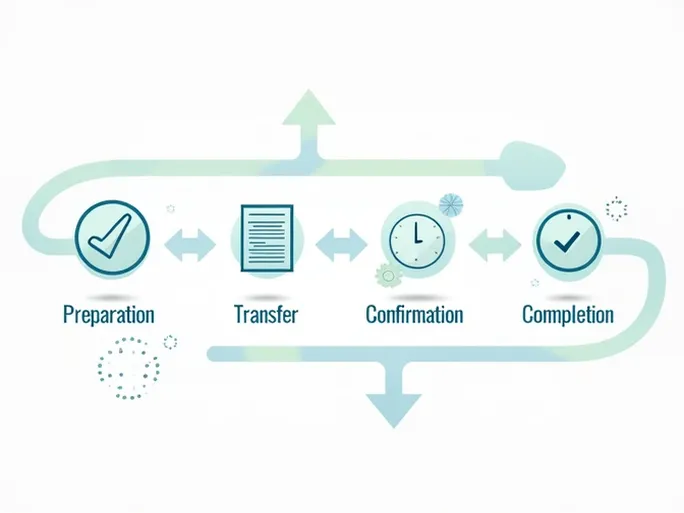

Key Steps for International Transfers

Before initiating an international transfer, several details must be verified, with the SWIFT/BIC code being the most crucial. Priorbank’s primary SWIFT/BIC code is PJCBBY2XXXX , which identifies its main office. However, certain branches or services may require alternative codes. To ensure accuracy, always confirm the correct SWIFT/BIC code with the recipient before proceeding.

Priorbank’s registered address is V. KHORUZHEY STREET, 31A, MINSK, BELARUS . When preparing for a transfer, gather all necessary details, including the recipient’s full name, account number, and any additional information required by intermediary banks. First-time senders should double-check these details to avoid delays or failed transactions.

Fees and Potential Challenges

International transfers often incur fees, which vary depending on the banks and countries involved. These may include processing charges, intermediary bank fees, or currency conversion costs. Researching these expenses beforehand helps in budgeting effectively.

Common issues during transfers include:

- Delays: Cross-border transactions may take longer due to multiple bank processes. Allowing extra time for the transfer prevents misunderstandings.

- Incorrect Details: Errors in SWIFT codes or account numbers can result in failed transfers. Always verify information through official channels.

Additional Considerations

Digital remittance services are increasingly popular for their speed and affordability. Frequent senders may explore these alternatives alongside traditional banking methods.

Exchange rates also play a significant role. Banks typically use real-time market rates for currency conversion, which may affect the final amount received. Monitoring exchange trends before transferring can optimize outcomes.

Conclusion

Successful international transfers rely on accurate information, from SWIFT codes to recipient details. Priorbank’s established infrastructure ensures reliable transactions, but thorough preparation remains key. Whether for business or personal purposes, maintaining clear communication and staying informed about banking policies minimizes risks and enhances efficiency in global financial operations.