In today's globalized economy, international money transfers have become an essential part of personal and business transactions. Whether for family support, travel expenses, or cross-border business dealings, ensuring accuracy at every step is crucial when sending money abroad. Among the various options for international transfers, Italy's Credit Agricole Italia bank stands out for its reliable services and extensive network. Therefore, understanding Credit Agricole Italia's SWIFT/BIC code is vital for successful international transactions.

The Importance of SWIFT/BIC Codes

SWIFT/BIC codes are standardized identification numbers used by banks and financial institutions for international transfers. Each bank has its unique SWIFT code, facilitating secure and efficient fund transfers between senders and recipients. For Credit Agricole Italia, the primary SWIFT/BIC code is CRPPIT2PXXX , though specific branches or service providers might use different codes. Verifying the correct code is essential to ensure your transfer reaches its intended destination.

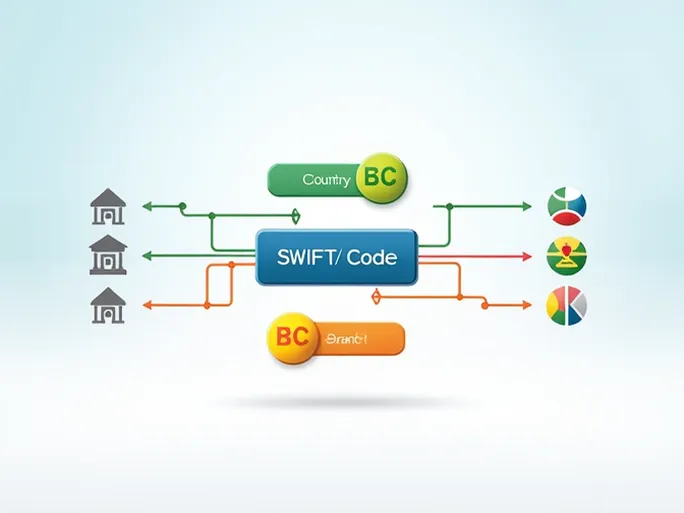

SWIFT codes follow a specific format that helps identify and categorize financial transactions. These codes typically consist of 8 to 11 characters:

- First 4 characters: Bank code (identifies the financial institution)

- Next 2 characters: Country code (indicates the bank's location)

- Following 2 characters: Location code (specifies the city or region)

- Last 3 characters (optional): Branch code (identifies a specific branch)

For Credit Agricole Italia's code CRPPIT2PXXX :

- CRPP represents the bank's identifier.

- IT denotes Italy as the country.

- 2P specifies the bank's location within Italy.

- XXX typically indicates the bank's headquarters, meaning transfers are processed through its main office.

When to Use Credit Agricole Italia's Primary SWIFT Code

The main SWIFT/BIC code CRPPIT2PXXX is appropriate in several scenarios:

- When sending money to Credit Agricole Italia without knowing a specific branch code.

- When the recipient hasn't provided a detailed SWIFT/BIC code.

- When the bank prefers processing transactions through its central headquarters.

- When seeking a universally accepted SWIFT/BIC code for general transfers.

Essential Information for International Transfers

Beyond the SWIFT/BIC code, several other details are necessary for successful international transfers:

- Recipient's bank account number

- Recipient's full name and address

- Additional bank information as required

Providing accurate information helps prevent delays or errors, especially in cross-border transactions where incomplete or incorrect details can lead to failed transfers.

Selecting the Right Transfer Service

Choosing an appropriate transfer service depends on factors such as:

- Transfer amount

- Processing time

- Applicable fees

- Exchange rates

Credit Agricole Italia offers various international transfer options for both personal and business needs. The bank's reputation for customer service and reliability makes it a preferred choice for many clients.

Digital Banking and International Transfers

Credit Agricole Italia's robust digital platform enhances the banking experience, allowing customers to manage international transfers conveniently through online banking or mobile apps. Users can easily access necessary details, including SWIFT/BIC codes, streamlining the process.

Understanding Transfer Fees and Exchange Rates

International transfers with Credit Agricole Italia involve fees that vary based on:

- Transfer amount

- Transfer method

- Destination country

Exchange rate fluctuations also impact the final amount received, particularly for large transfers. Monitoring currency trends before initiating a transaction can help optimize timing.

Corporate International Payment Solutions

For businesses, Credit Agricole Italia provides comprehensive international payment services, including:

- Letters of credit

- Bank guarantees

- Currency exchange solutions

Leveraging the bank's global network and expertise supports seamless cross-border business operations.

Initiating an International Transfer with Credit Agricole Italia

To begin:

- Open an account with Credit Agricole Italia, providing required identification and documentation.

- Log in to your online banking account.

- Enter the necessary transfer details, including the SWIFT/BIC code and recipient's account information.

- Review all information for accuracy before confirming the transaction.

Processing times for international transfers may range from a few hours to several days. Tracking features allow senders to monitor transaction progress.

Understanding Credit Agricole Italia's SWIFT/BIC code and related transfer requirements ensures smooth, secure international transactions for both individuals and businesses. With its professional services and customer-focused approach, Credit Agricole Italia remains a trusted partner in global finance.