In our increasingly interconnected world, cross-border fund transfers have become an essential part of daily life. Whether conducting international trade or sending money to family overseas, accurate and efficient financial flows are paramount. The SWIFT code (also known as BIC code) serves as the backbone of these transactions, ensuring funds reach their intended destination promptly and without error.

Consider FLORNL2ABEX as an example—this unique identifier represents more than just a random string of characters. When transferring funds to Amsterdam's NEDERLANDSCHE BANK (DE) N.V. , this SWIFT code acts as both communication bridge and financial GPS. Including it in your transfer instructions significantly improves transaction success rates while minimizing delays caused by incorrect information.

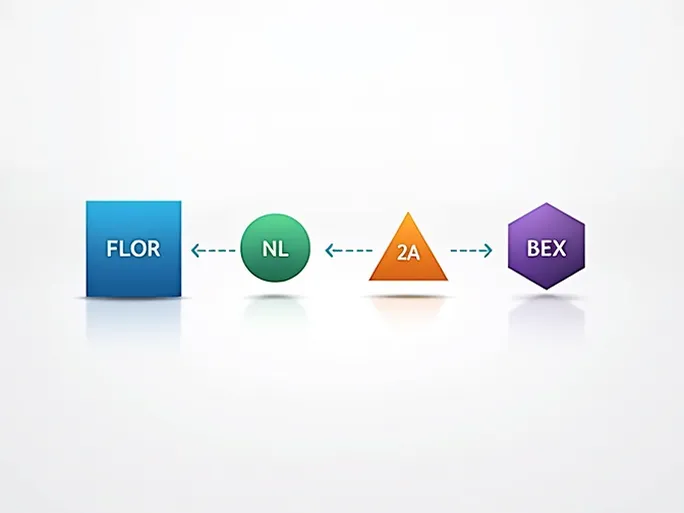

The structure of FLORNL2ABEX reveals the precision behind SWIFT codes. The first four characters ( FLOR ) identify the bank, followed by the two-letter country code ( NL for Netherlands). The next two characters ( 2A ) specify the location, while the final three ( BEX ) pinpoint the exact branch. This meticulous coding system provides clear navigation through global financial networks.

Understanding SWIFT codes constitutes fundamental knowledge for international transfers. Before initiating any transaction, verify the code's accuracy against the recipient bank's official name, branch details, and country. While seemingly simple, this step prevents potential complications and ensures smooth financial movement.

In the international banking ecosystem, SWIFT/BIC codes function as unique identifiers—financial passports that distinguish each institution. Their specificity prevents funds from getting lost in complex global networks. Regardless of transfer amounts, correct SWIFT code usage remains critical for successful transactions.

When dealing with NEDERLANDSCHE BANK (DE) N.V. , using FLORNL2ABEX provides additional security. The bank's global reputation for reliable service, combined with accurate SWIFT code implementation, facilitates faster transfers and reduces unnecessary complications.

While international transfers may seem daunting, mastering SWIFT codes transforms the process. Proper use of FLORNL2ABEX not only accelerates transactions but also enhances financial management. In cross-border finance, minor errors can cause significant delays—making code verification essential.

Beyond SWIFT codes, consider transfer options and associated fees. Comparing bank policies helps optimize costs and processing efficiency. Traditional SWIFT transfers often involve fees that vary by institution and amount, while emerging fintech solutions may offer faster, more transparent alternatives. However, traditional methods typically provide superior security measures.

Processing times also warrant attention, particularly for currency conversions. Planning large transfers in advance accommodates potential delays. Meanwhile, digital financial services enable real-time tracking, though traditional banking channels remain preferable for high-value transactions due to enhanced security protocols.

The SWIFT network employs robust encryption and multi-factor authentication to safeguard transactions. Users should remain vigilant with sensitive data and select reputable financial partners to ensure fund security.

Ultimately, FLORNL2ABEX represents more than a banking code—it's the critical link between senders and NEDERLANDSCHE BANK (DE) N.V. , enabling seamless global transactions. By combining accurate SWIFT implementation with informed financial decisions, individuals and businesses can navigate international finance with confidence.