In the process of international money transfers, accurate bank account information is crucial. Have you ever felt confused about your IBAN (International Bank Account Number)? Today, we will break down the IBAN format for the Czech Republic to help you complete overseas transactions smoothly.

The Structure of an IBAN

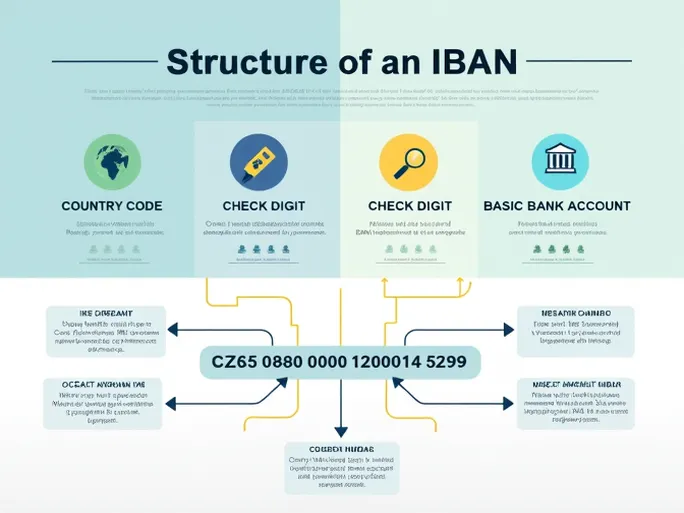

The International Bank Account Number (IBAN) is a unique identifier composed of letters and numbers, with a maximum length of 34 characters. It is designed to simplify the processing of cross-border transfers worldwide. Each IBAN consists of three parts: the country code, check digits, and the Basic Bank Account Number (BBAN).

- Country Code : The country code for the Czech Republic is CZ.

- Check Digits : These are two-digit numbers (e.g., 65 in the example below) that ensure the accuracy of the account number.

- BBAN : This includes the bank identifier and the actual account information.

Example of an IBAN Format

Let’s examine a specific example. Suppose you need to fill in your IBAN:

- Bank Identifier : 0800

- Account Number : 0000192000145399

This format ensures that banks can process your transfer instructions quickly and accurately.

How to Find Your IBAN

Locating your personal IBAN is relatively straightforward. You can find it by logging into your online banking platform or checking a recent bank statement. When sending money abroad, using the correct IBAN is essential—any errors may result in additional fees or misdirected funds.

The Role of IBAN in International Transfers

When conducting international transfers with most European banks, you will be required to provide an IBAN. The IBAN not only enhances the security of transactions but also ensures that funds reach their intended destination seamlessly. While an increasing number of countries have adopted this standard, some regions may still require additional information.

Historical Background of the IBAN

Before delving deeper into the IBAN, it is important to understand its historical context. The IBAN was created to streamline cross-border money transfers. As global trade expanded, traditional banking systems struggled to meet the demands of international transactions. In the 1990s, the International Organization for Standardization (ISO) and the European Banking Association (EBA) collaborated to develop this standard.

The first version of the IBAN was introduced in 1997 and has since become a cornerstone of global financial transactions. Its primary purpose is to reduce errors and improve processing speeds, making international payments secure and reliable.

Components of the IBAN: A Closer Look

As mentioned earlier, the IBAN consists of a country code, check digits, and BBAN. Below, we explore these components in greater detail.

1. Country Code

The country code is a two-letter identifier based on the ISO 3166-1 alpha-2 standard. For example:

- Czech Republic: CZ

- Germany: DE

- France: FR

This code allows banks to quickly identify the recipient’s country, facilitating efficient cross-border payments.

2. Check Digits

The check digits are a two-digit number that validates the IBAN’s accuracy. When a bank receives an IBAN, it first verifies these digits using a predefined algorithm. If the check digits do not match, the IBAN will be rejected. This design significantly reduces the risk of errors caused by manual entry.

3. Basic Bank Account Number (BBAN)

The BBAN is the most critical part of the IBAN. Its exact format and length vary by country. Typically, the BBAN includes the bank identifier and the customer’s actual account number, enabling banks to locate the account domestically with ease.

For instance, in the Czech Republic, the bank identifier is usually four digits long, followed by the customer’s account number. This structure ensures that the IBAN uniquely identifies a specific bank account.

The Importance of the IBAN

The IBAN is not merely a tool for simplifying transactions—it is an indispensable part of the international financial system. Its significance lies in the following aspects:

1. Reducing Errors

Manual data entry is prone to mistakes, but the IBAN minimizes these issues. The inclusion of check digits allows banks to automatically detect incorrect IBANs.

2. Increasing Speed

The standardized processing of IBANs accelerates transfers between banks. Eliminating the need for extensive verification reduces waiting times and ensures faster delivery of funds.

3. Enhancing Security

The structure of the IBAN introduces multiple validation steps, improving transaction security. This feature supports the rapid growth of global business operations.

Steps for Cross-Border Transfers

Now that you understand the IBAN, let’s explore the typical steps involved in executing an international transfer:

1. Gather Information

Ensure you have the recipient’s details, including their IBAN, bank name, and SWIFT/BIC code.

2. Choose a Transfer Method

Options include online banking, mobile banking apps, or visiting a bank branch. Each method has its pros and cons, such as fees and processing times.

3. Complete the Transfer Form

When filling out the transfer form (online or in person), carefully enter the recipient’s IBAN and other details to avoid errors.

4. Verify the Information

Before submitting, double-check all details, especially the IBAN, to prevent financial losses due to input mistakes.

5. Submit the Request

Once you confirm the information is correct, submit the request, pay any applicable fees, and await completion. Transfers typically take 1–5 business days, depending on the destination country and the bank’s processing time.

Regulations and Guidelines for IBAN Usage

Many countries have established regulations to ensure the smooth execution of international transfers.

1. European Union Regulations

Within the EU, the use of IBAN and SWIFT/BIC codes is widely promoted and accepted by media and banking organizations. Under EU law, all banks must accept IBANs for cross-border transfers.

2. Country-Specific Rules

Although the IBAN is an international standard, some countries have additional requirements, such as extra identity verification or proof of funds.

Common Misconceptions About IBANs

Users often encounter misunderstandings when dealing with IBANs. Here are a few:

1. All Countries Use IBANs

Not all countries have adopted the IBAN system. Some still rely on traditional bank account numbers. If you plan to send money to these countries, confirm the required payment method with your bank.

2. IBANs Can Be Modified Freely

IBANs are generated and managed by banks. Users should never alter them, as incorrect IBANs may delay or prevent the receipt of funds.

3. IBANs Are Only for European Countries

While the IBAN originated in Europe, it is now used in many countries across Africa, Asia, and other regions.

Conclusion

In an increasingly interconnected global economy, the IBAN has become a vital standard. It helps users avoid unnecessary fees caused by input errors while enhancing the security and reliability of fund transfers. Understanding the structure, usage, and procedures related to IBANs is essential for navigating the convenience of cross-border transactions. Whether for personal or business purposes, this knowledge ensures smooth and efficient international payments. If you have further questions, consult your bank for additional guidance.