The International Bank Account Number (IBAN) is a standardized format for bank account information used worldwide. Composed of alphanumeric characters and up to 34 digits long, the IBAN system was created to simplify international money transfers and ensure funds reach their destination accurately and efficiently. Understanding and properly using IBAN has become essential financial knowledge for anyone engaged in international trade, travel, or cross-border payments.

The Structure of an IBAN

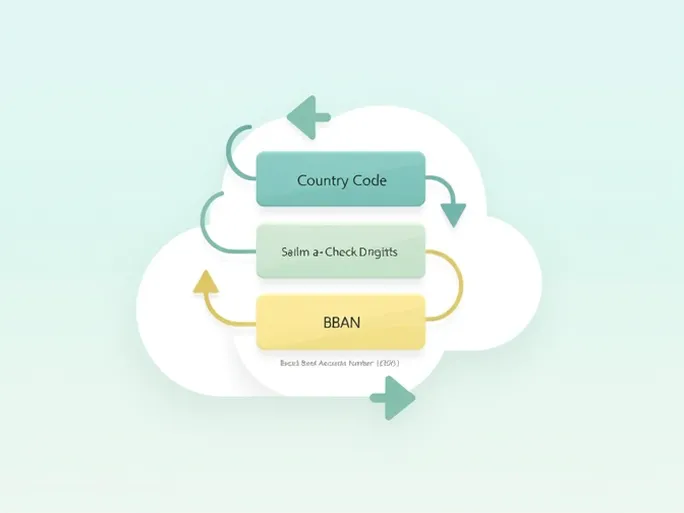

An IBAN's carefully designed structure consists of three key components that ensure both information integrity and readability:

- Country Code: Two letters identifying the country according to ISO 3166-1 alpha-2 standard

- Check Digits: Two numbers that validate the IBAN's authenticity

- Basic Bank Account Number (BBAN): A country-specific portion containing domestic bank and account details

In printed format, IBANs appear with spaces every four characters for readability, while electronic formats remove these spaces for computer processing. This design minimizes input errors that could cause payment failures.

IBAN Example: Estonia

EE38 2200 2210 2014 5685

- Country Code: EE (Estonia)

- Check Digits: 38

- BBAN: 2200 2210 2014 5685

- Bank Identifier: 22

- Branch Identifier: 00

- Account Number: 22102014568

- BBAN Check Digit: 5

- SEPA Member: Yes

Why IBAN Matters

Many banks require IBANs for international transfers to ensure security and accuracy. The system offers several key advantages:

- Reduces delays and confusion from missing or incorrect information

- Consolidates all necessary banking details in one standardized format

- Includes built-in validation through check digits

- Speeds up international money transfers

Finding Your IBAN

Locating your IBAN is straightforward through these methods:

- Online Banking: Most banks display IBANs in account information or transfer sections

- Bank Statements: Many institutions print IBANs on statements

- Bank Customer Service: Contact your bank directly if other methods fail

Always verify IBAN accuracy before initiating transfers to prevent delays or additional fees for correcting errors.

Global Usage and Limitations

While nearly all European banks require IBANs and the system has gained global adoption, limitations exist:

- Not all countries follow the IBAN standard

- IBANs don't specify currency, which may require additional verification

- Some regions still require supplementary information like SWIFT/BIC codes

Historical Context

The IBAN system emerged in 1987 through the International Organization for Standardization (ISO) as global trade expanded. European adoption in the 1990s helped reduce cross-border payment costs and processing times. Today, IBAN serves as an industry standard particularly in Europe, Africa, and the Middle East.

Making Payments with IBAN

The process for using IBAN in international transfers is simple:

- Confirm the recipient's correct IBAN

- Access your online banking

- Select international transfer options

- Enter recipient details including IBAN and SWIFT/BIC code

- Verify all information before submission

Processing times typically range from 1-5 business days depending on countries and banks involved.

Future Developments

As financial technology advances, IBAN's role in international banking continues to grow. More countries are considering adoption to streamline cross-border transactions. Emerging technologies like blockchain may further integrate with IBAN systems to enhance transparency and efficiency in global payments.